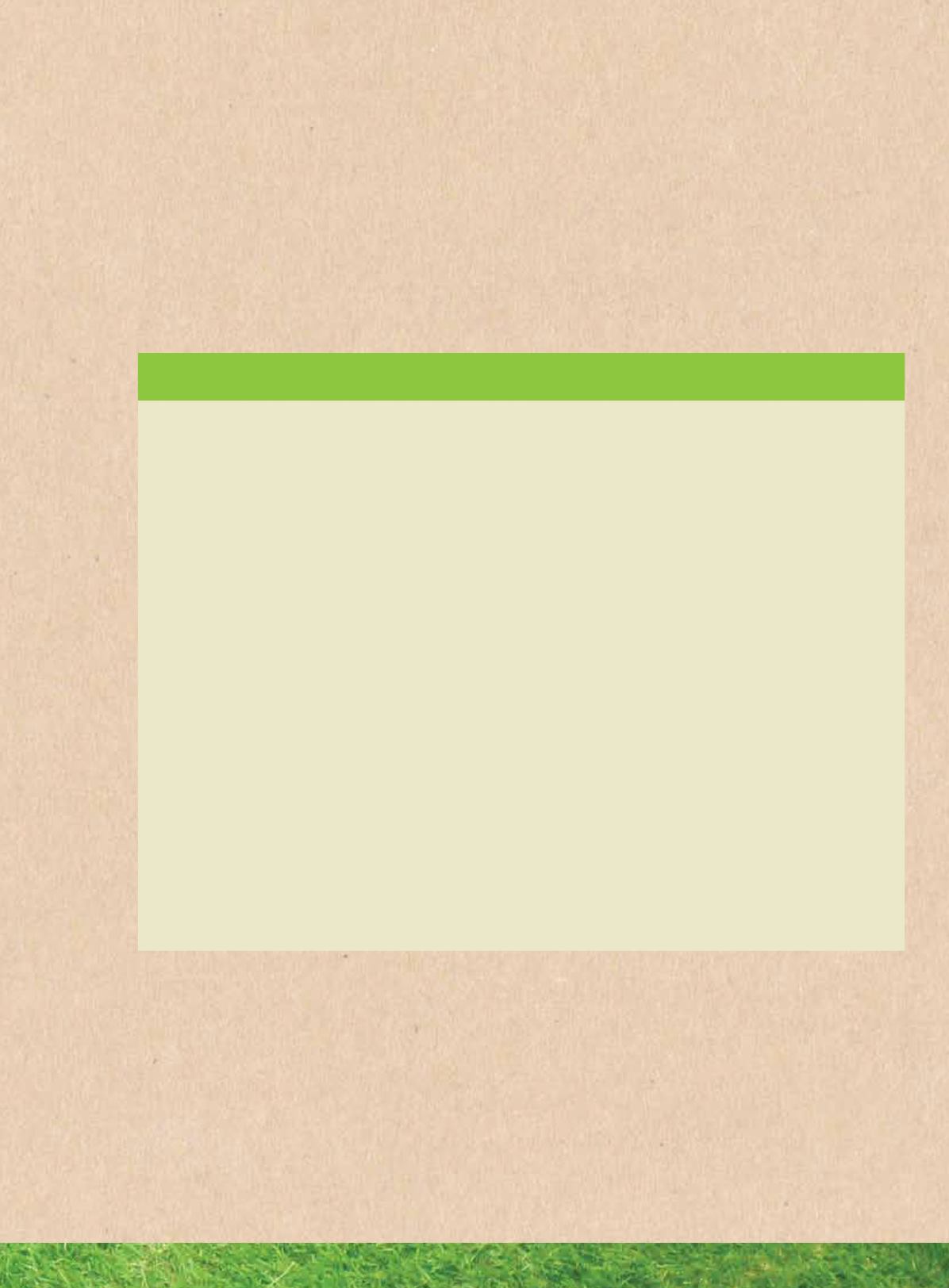

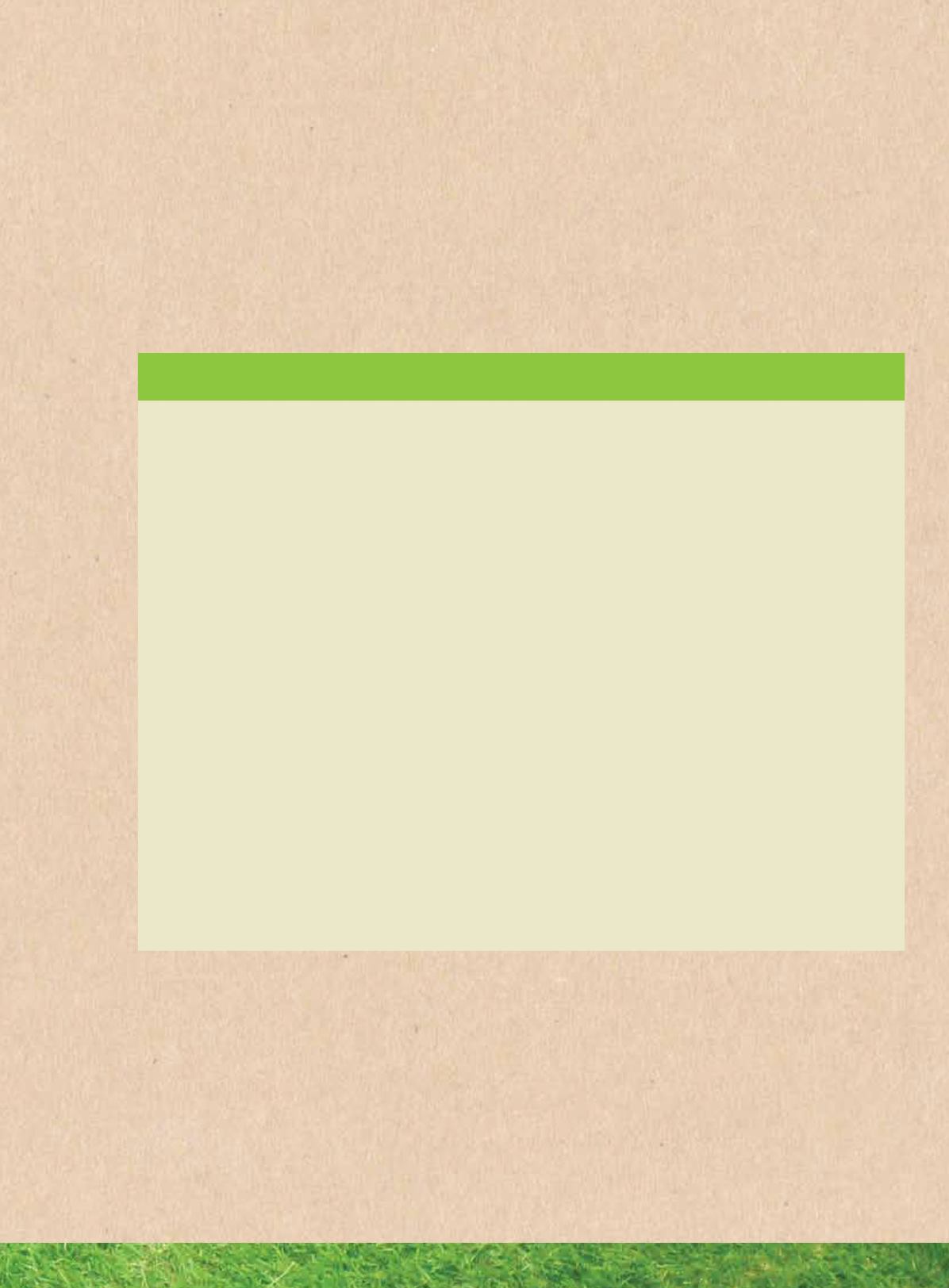

49

GroupQuarterlyResults

Q1

Q2

Q3

Q4

Full Year

$'000

$'000

$'000

$'000

$'000

Revenue

2013

25,059

22,142

20,718

15,380

83,299

2012

35,101

25,035

21,706

16,402

98,244

Gross Profit

2013

6,025

4,663

6,672

6,408

23,768

2012

4,909

7,061

8,109

5,005

25,084

Pre-taxprofit

2013

4,215

12,160

4,479

5,226

26,080

2012

14,245

62,290

6,905

1,359

84,799

Net profit

2013

3,247

11,320

3,619

4,187

22,373

2012

13,605

61,330

5,705

952

81,592

Gross profitmargin

2013

24% 21% 32% 42% 29%

2012

14% 28% 37% 31% 26%

Net profitmargin

2013

13% 51% 17% 27% 27%

2012

39% 245% 26%

6% 83%

Group revenue increased quarter-on-quarter to $25.1million in 1Q2013, but declined progressively over the next 3 quarters.

This was attributable to a lower contribution from new projects in line with the general slowdown of order intake from July

2012 until June 2013. The effectswere particularly felt during the final 2quarters of 2013.

Gross profitmargins varieddependingon the productmix and stages of constructionof the projects beingundertakenduring

the variousquarters.Notably, grossprofitmarginwerehigher at 42% in4Q2013due to improvements inproductionefficiency

for certain projects and reached a low of 14% in 1Q2012 due to a different product mix and more competitive pricing for

certainprojects. Additionally, a significant portionof theGroup’s revenue for 1Q2012was fromprojects in their early stages of

construction, where themargins recognised tend to be lower.

The surge in pre-tax profits in 2Q2013, 1Q2012 and 2Q2012were due to gains on disposal of investments, namely DO ($8.8

million), York ($10.9million), and the recognition of the deferred gain on disposal of PPLH ($58.2million), respectively.