Corporate

Governance

Corporate

Governance

59

BAKER TECHNOLOGY LIMITEDANNUAL REPORT 2012

58

BAKER TECHNOLOGY LIMITEDANNUAL REPORT 2012

The Board has direct and independent access to

Company’s Senior Management and the Company

Secretary for support in the discharge of their

responsibilities. The Company Secretary attends all

Board and committee meetings and ensures that

all Board procedures are followed. The Company

Secretary, together withManagement, also ensures that

the Company complies with all applicable statutory and

regulatory rules. Theminutes of all Board and committee

meetings are circulated to theDirectors. Theappointment

and removal of the Company Secretary is subject to the

approval of the Board.

REMUNERATIONMATTERS

Procedures forDeveloping

RemunerationPolicies

Principle7:

There should be a formal and transparent procedure for

developing policy on executive remuneration and for

fixing the remuneration packages of individual directors.

No director should be involved in deciding his own

remuneration.

LevelandMixofRemuneration

Principle8:

The level of remuneration should be appropriate to

attract, retain and motivate the directors needed to run

the company successfully but companies should avoid

paying more than is necessary for this purpose. A

significantproportionofexecutivedirectors’remuneration

should be structured so as to link rewards to corporate

and individual performance.

DisclosureonRemuneration

Principle9:

Each company should provide clear disclosure of its

remuneration policy, level andmix of remuneration, and

the procedure for setting remuneration in the company’s

annual report. It shouldprovidedisclosure in relation to its

remuneration policies to enable investors to understand

the link between remuneration paid to directors and key

executives, and performance.

TheRemunerationCommittee (“RC”) comprises threenon-

executive directors, namelyMr LimHoSeng (Chairman),

Mr Tan Yang Guan and Mr Wong Meng Yeng. Mr Lim

and Mr Wong are independent directors. Mr Tan is a

non-independent director.

The RC is guided by its Terms of Reference, which sets

out it responsibilities. The RC reviews the framework

of remuneration for Directors serving on the Board

and Board committees. In reviewing the remuneration

of Directors and key executives, the RC considers the

market conditions, pay conditions within the industry as

well as theCompany’s performance and the individual’s

performance. None of the RC members or Directors is

involved in deliberations in respect of any remuneration,

compensation or any form of benefit to be granted to

him. The RC also has access to external professional

advice on executive compensation and remuneration

matters, if andwhen required.

The Group’s remuneration policy comprises two

components. One component is fixed in the form of a

base salary which includes the 13

th

month based AWS.

The other component is the variable bonus which is

dependent on the financial performance of the Group

and the individual’s performance.

The Baker Group Share Option Scheme 2002 expired

inMay 2012.

All independent non-executive Directors are paid

Directors’ fees which are subject to approval at AGMs.

The non-executive Chairman of the Board is paid a

consultancy fee of S$18,000 for his involvement in

matters relating to Investor Relations.

There are no employees in the Company who are

immediate family members of any of the directors or

the CEO and whose remuneration exceeds S$150,000

during FY2012.

ACCOUNTABILITYANDAUDIT

Accountability

Principle10:

TheBoardshouldpresentabalancedandunderstandable

assessment of the company’s performance, position and

prospects.

The Board, through its announcements of quarterly

and full-year results as well as price sensitive issues,

aims to provide shareholders with a balanced and

understandable assessment of the Group’s financial

performance, position and prospects.

The Company recognises the importance of providing

the Board with a continual flow of relevant information

on an accurate and timely basis in order that it may

effectively discharge its duties.

On a regular basis, Board members are provided

with business and financial reports comparing actual

performance with budget, highlights on key business

indicators and other major issues.

AuditCommittee

Principle11:

The Board should establish an Audit Committee with

written terms of reference which clearly set out its

authority and duties.

The Audit Committee (“AC”) comprises Mr LimHo Seng

(CommitteeChairman),MrTanYangGuan (Member)and

Mr Wong Meng Yeng (Member), all of whom are non-

executive directors. The majority of the members have

relevant accounting or related financial management

expertise and experiencewith theChairman andMr Tan

YangGuan being qualified accountants.

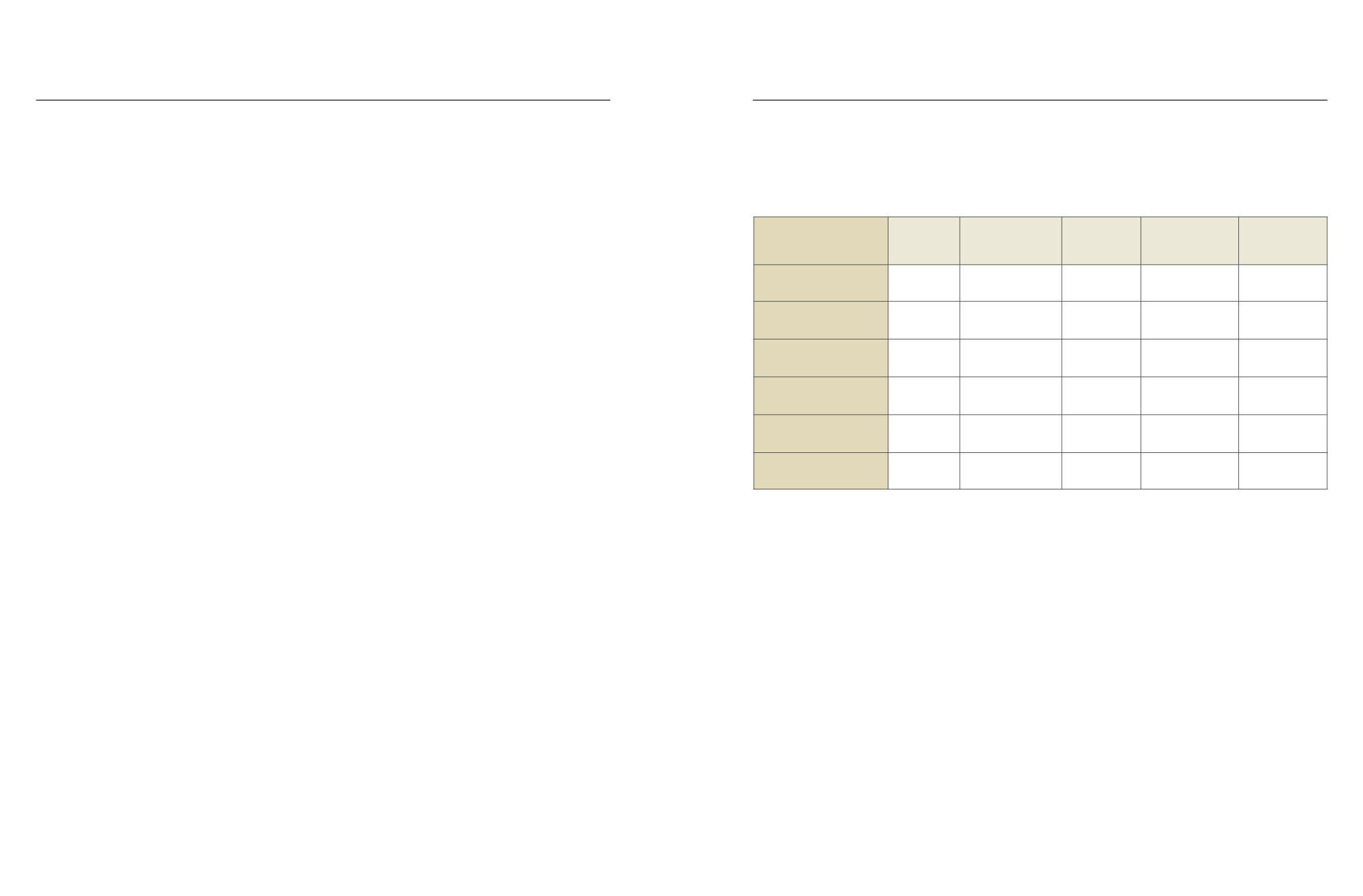

A breakdown showing the level andmix of the Directors’ remuneration payable for FY2012 is as follows:

Directors’ Remuneration

Name of Directors

Fees

(S$)

Salary, CPF

andAllowance

(S$)

Bonus

(S$)

Other Benefits

(S$)

Total

(S$)

LimHo Seng

70,625*

-

-

18,000**

88,625

Dr Benety Chang

-

273,310

1,045,000

22,000

1,340,310

Anthony Sabastian Aurol

-

433,390

1,031,000

22,400

1,486,790

Tan YangGuan

-

-

-

169,110**

169,110

Wong Kwan Seng Robert

35,000*

-

-

-

35,000

WongMeng Yeng

56,875*

-

-

-

56,875

* these fees are subject to approval by shareholders as a lump sum at the forthcomingAGM.

** this relates to consultancy fees paid by theCompany.