80

81

BAKER TECHNOLOGY LIMITED ANNUAL REPORT 2012

BAKER TECHNOLOGY LIMITED ANNUAL REPORT 2012

for the financial year ended 31december 2012

notestothe

financialstatements

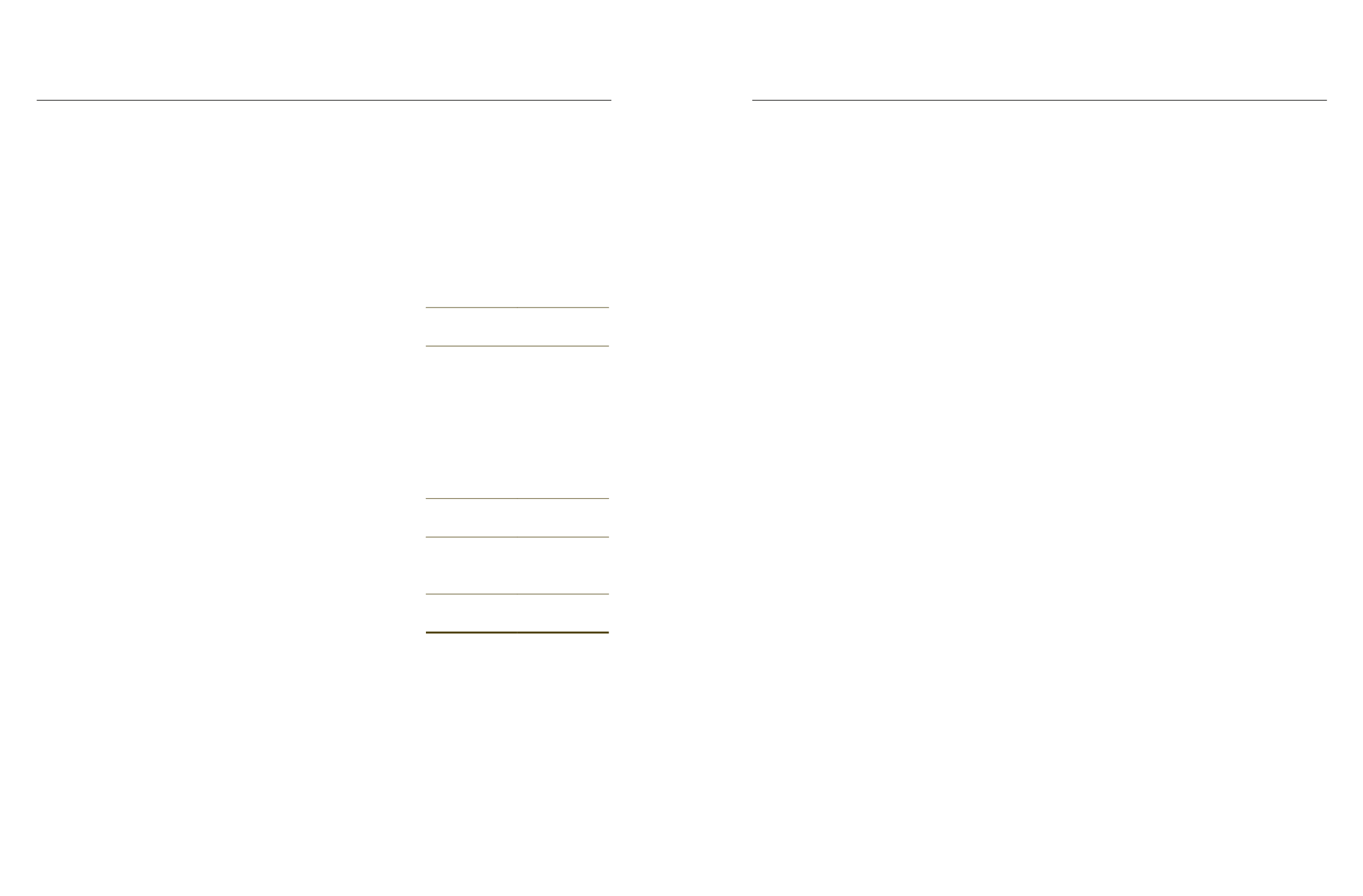

consolidatedcash

flowstatement

for the financial year ended 31december 2012

2012

2011

$

$

Cash flows from investing activities :

Dividend received

–

101,170

Purchase of property, plant and equipment

(394,317)

(381,359)

Net proceeds from disposal of associated company

21,850,674

–

Purchase of available-for-sale investment

(4,412,595)

(27,618,028)

Net cash flows from/(used in) investing activities

17,043,762 (27,898,217)

Cash flows from financing activities

Net proceeds from conversion of warrants

11,720,257

5,524,822

Net proceeds fromwarrant issue

2,543,170

–

Dividends paid on ordinary shares

(7,002,949)

(20,997,099)

Repayment of obligations under finance leases

–

(99,048)

Proceeds from loans and borrowings

17,666,533

–

Repayment of loans and borrowings

(13,988,484)

–

Net cash flows from/(used in) in financing activities

10,938,527 (15,571,325)

Net increase/(decrease) in cash and cash equivalents

4,624,749 (44,853,561)

Cash and cash equivalents at beginning of financial year

169,276,813 214,130,374

Cash and cash equivalents at end of financial year (Note 22)

173,901,562 169,276,813

The accompanying accounting policies and explanatory notes form an integral part of the financial statements.

1. Corporate information

Baker Technology Limited (the “Company”) is a limited liability company incorporated and domiciled in

Singapore and is listed on the Singapore Exchange Securities Trading Limited (SGX-ST).

The registered office and principal place of business of the Company is at 6 Pioneer Sector 1, Singapore

628418.

The principal activity of the Company is investment holding. The principal activities of the subsidiaries and

associates are disclosed inNotes 13 and 14 to the financial statements, respectively.

2. Summaryof significant accounting policies

2.1 Basis of preparation

The consolidated financial statements of theGroupand the balance sheet and statement of changes in equity of

theCompany have been prepared in accordancewith Singapore Financial Reporting Standards (“FRS”).

The financial statements have been prepared on a historical cost basis, except as disclosed in the accounting

policies below, and are presented in Singapore Dollars (S$ or $).

The accounting policies adopted are consistent with those of the previous financial year except in the current

financial year, the Group has adopted all the new and revised standards and Interpretations of FRS (INT FRS)

that areeffective for annual periods beginningonor after 1 January2012. Theadoptionof these standards and

interpretations did not have any effect on the financial performance or position of theGroupand theCompany.

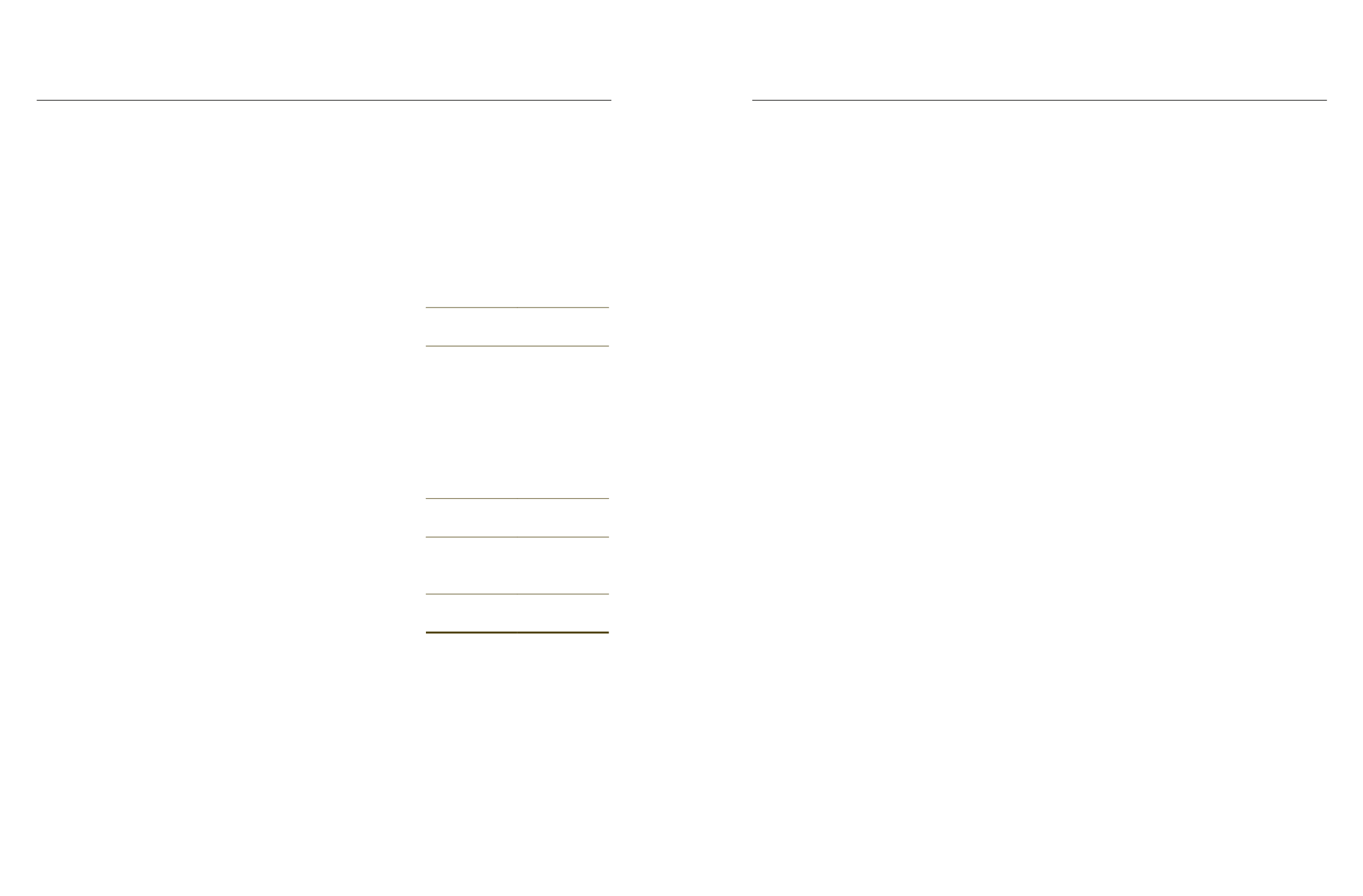

2.2 Standards issued but not yet effective

The Group has not adopted the following standards and interpretations that have been issued but not yet

effective:

Description

Effective for annual

periods beginning

on or after

Amendments to FRS 1 Presentation of Items of Other Comprehensive Income

1 July 2012

Revised FRS 19 Employee Benefits

1 January 2013

FRS 113 Fair ValueMeasurements

1 January 2013

Amendments to FRS 107Disclosure –Offsetting Financial Assets

and Financial Liabilities

1 January 2013