BAKERTECHNOLOGYLIMITED

ANNUALREPORT2013

128

Notes to the

Financial Statements

for the financial year ended 31December 2013

30. Financial riskmanagementobjectivesandpolicies (cont’d)

Credit risk

Credit risk is the riskof loss thatmay ariseonoutstandingfinancial instruments should a counterpartydefault on its obligations. The

Group’s exposure to credit risk arises primarily from trade and other receivables. For other financial assets (including cash and cash

equivalents), theGroupminimises credit risk by dealing exclusivelywith high credit rating counterparties.

The Group’s objective is to seek continual revenue growth while minimising losses incurred due to increased credit risk exposure.

TheGroup trades onlywith recognised and creditworthy third parties. It is theGroup’s policy that all customers whowish to trade

on credit terms are subject to credit verificationprocedures. In addition, receivablebalances aremonitoredon anongoingbasiswith

the result that theGroup’s exposure to bad debts is not significant.

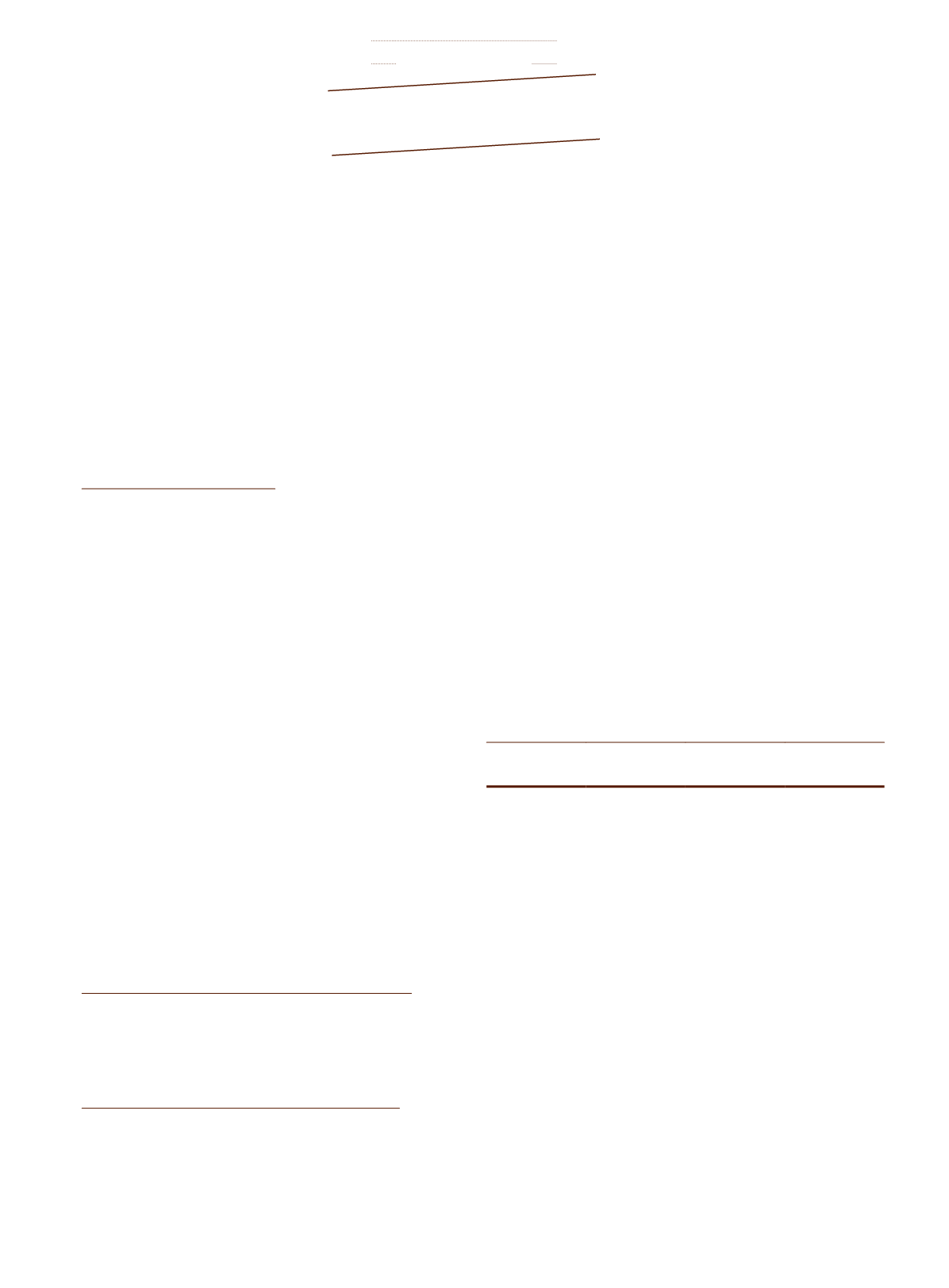

Credit risk concentration profile

The Group determines concentrations of credit risk bymonitoring the country profile of its trade receivables on an ongoing basis.

The credit risk concentration profile of theGroup’s trade receivables at the end of the reporting period is as follows:

Group

By country

2013

$

%of

total

2012

$

%of

total

Singapore

9,415,233

77 6,598,194

36

China

2,820,239

23 10,262,496

56

Middle East

39,530

–

172,424

1

Asia Pacific (excludingChina and Singapore)

17,297

– 1,210,645

7

12,292,299

100 18,243,759

100

At the end of the reporting period, approximately:

-

95% (2012: 97%) of theGroup’s trade receivableswere due from2 (2012: 5)major customerswho are located in Singapore

andChina.

-

A nominal amount of approximately $53,607,000 (2012: $39,040,000) relating to a corporate guarantee provided by the

Company to banks for its subsidiaries’ banking facilities.

Financial assets that are neither past due nor impaired

Trade and other receivables that are neither past due nor impaired are creditworthy debtors with good payment record with the

Group. Cash and short-termdeposits that areneither past duenor impaired areplacedwithor entered intowith reputablefinancial

institutionswithhigh credit ratings and no history of default.

Financial assets that are either past due or impaired

Information regarding financial assets that are either past due or impaired is disclosed inNote 19 (Trade andother receivables).