Baker Technology LimitedAnnual Report 2014

111

9.

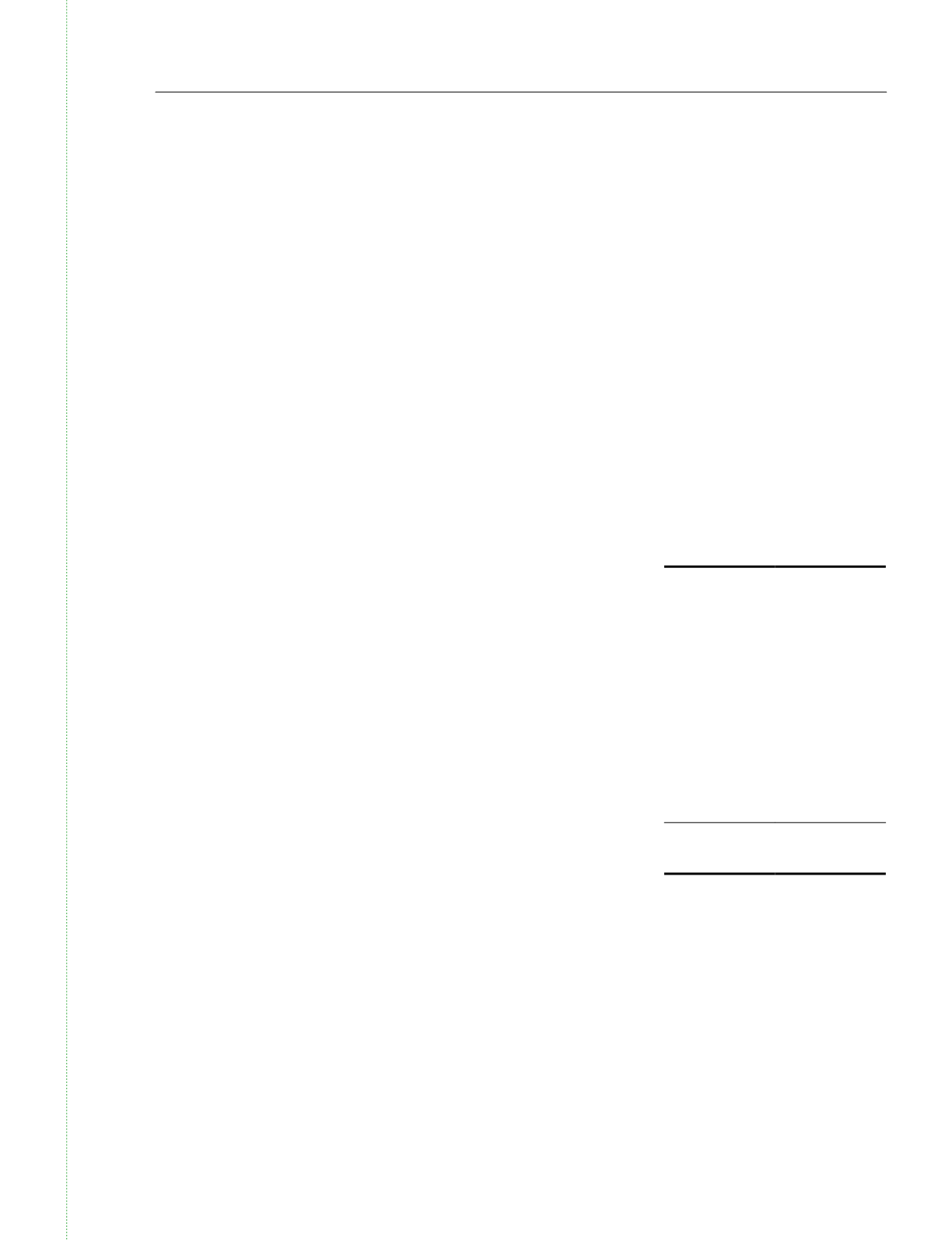

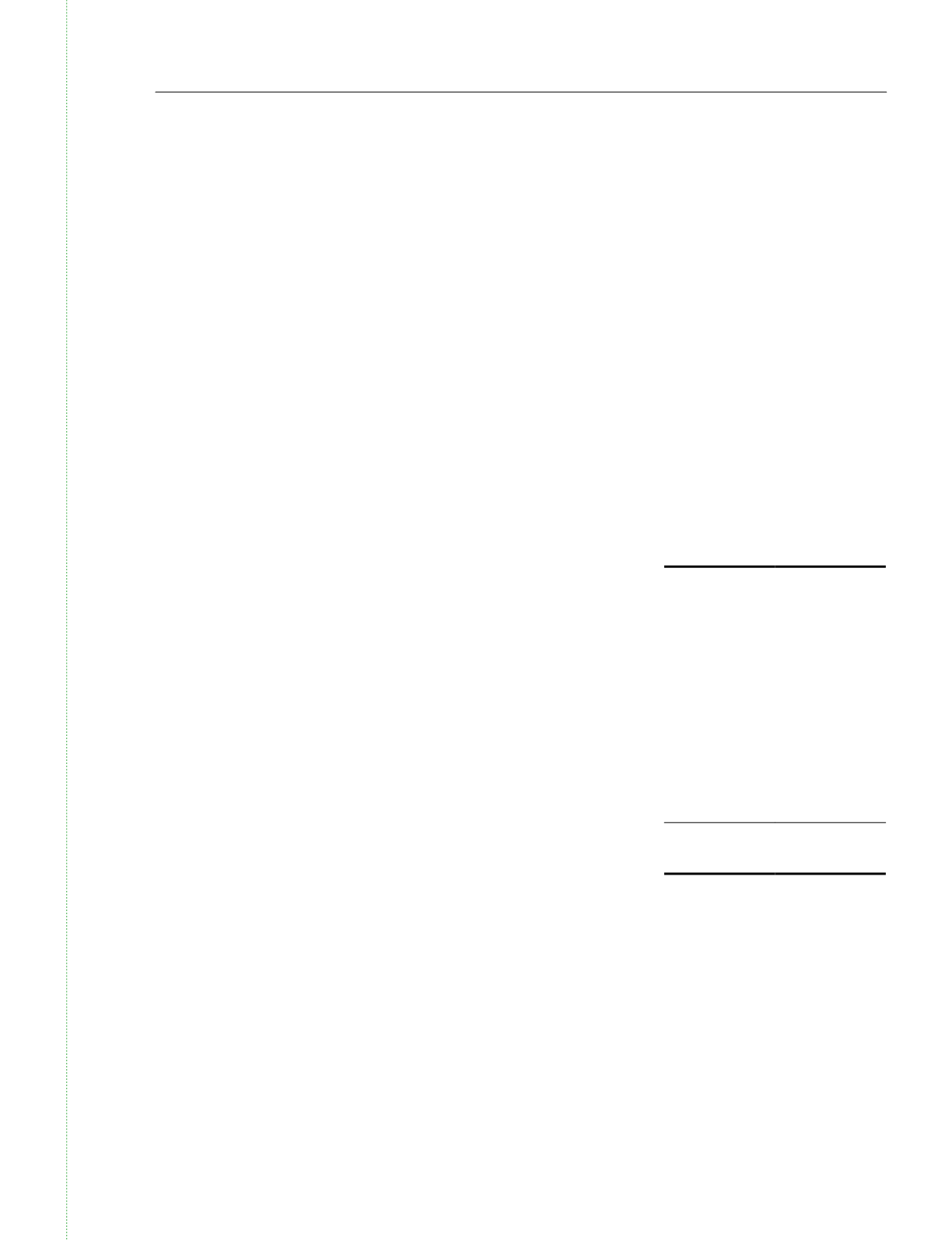

Income tax expense (cont’d)

(b)

Relationshipbetween tax expense and accountingprofit

A reconciliation between tax expense and the product of accounting profit multiplied by the

applicable corporate tax rate for the years ended 31December are as follows:-

Group

2014

2013

$

$

Accountingprofit before tax

16,325,885

26,080,025

Income taxexpenseat theapplicable tax rateof 17% (2013: 17%)

2,775,401

4,433,604

Adjustments for tax effect of:

Unrecogniseddeferred tax assets

33,055

–

Incomenot subject to taxation

(143,194)

(1,507,142)

Tax incentive

(115,250)

–

Non-deductibleexpenses

381,110

378,474

Underprovision in respect of prior years

15,775

471,194

Tax exemption

(77,775)

(75,578)

Others, net

(60,347)

6,642

Income tax expense recognised inprofit or loss

2,808,775

3,707,194

Thegainondisposal of an associate is capital innature andnot taxable.

A loss-transfer systemof group relief (the“GroupRelief System”) for companieswas introduced in

Singaporewith effect from year of assessment 2003. Under theGroup Relief System, a company

belonging to a group of entities may transfer its current year’s unabsorbed capital allowances,

unabsorbed trade losses and unabsorbed donations (loss items) to another company belonging

to the samegroup, tobededucted against the latter’s assessable income.

NOTES TO THE

FINANCIAL STATEMENTS

For the financial year ended 31December 2014