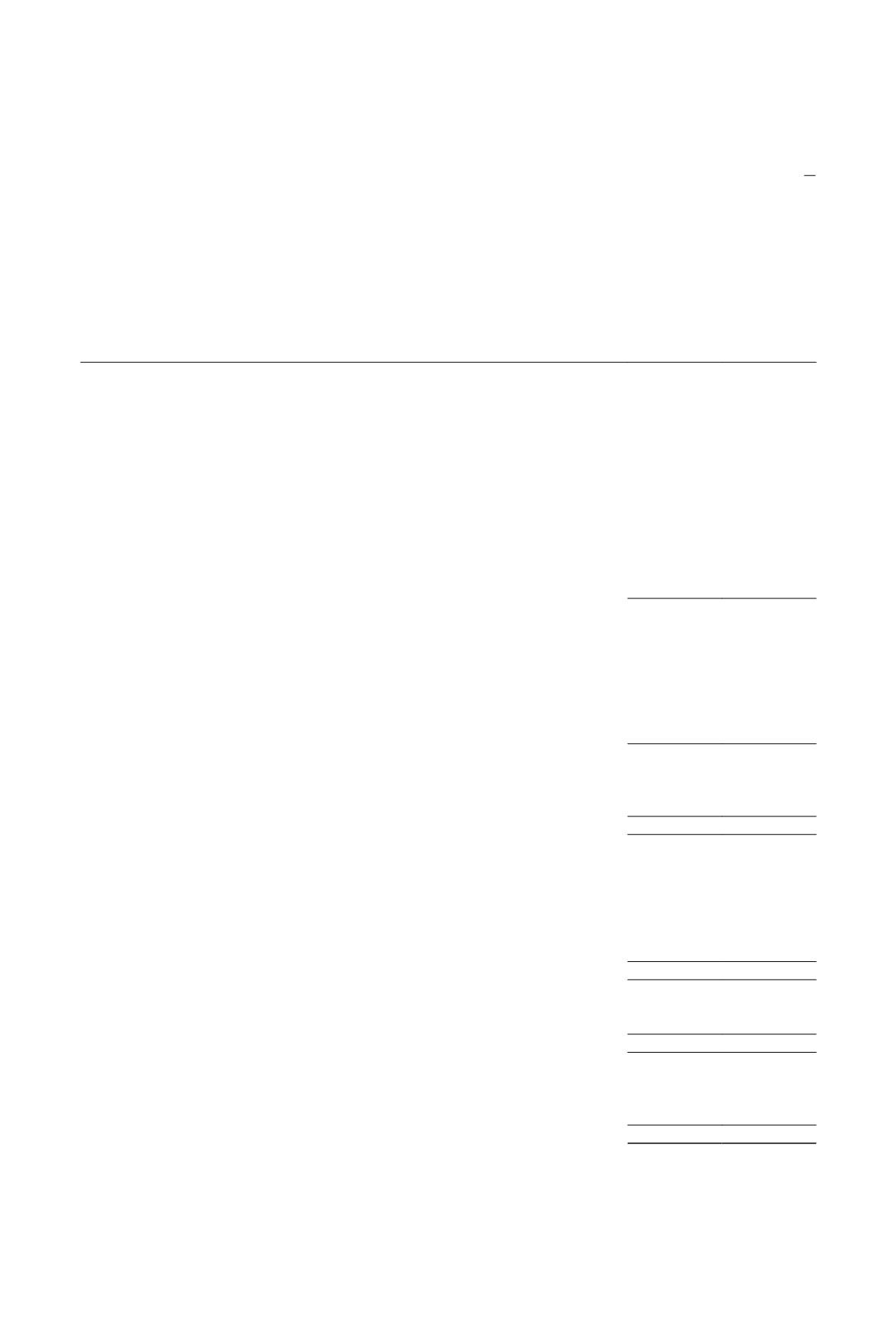

. 81

ANNUAL

REPORT

20 1 7

THE BE ST

I N US

2017

2016

$’000

$’000

Cash flows fromoperatingactivities

Loss before tax

(11,283)

(9,222)

Adjustments for:

Depreciationof property, plant andequipment

2,806

1,911

Amortisationof intangible assets

22

–

Inventories andwork-in-progresswrittendown

501

1,391

Allowance for doubtful debt

–

63

Interest income

(661)

(668)

Writeback forwarranty

(1,176)

(645)

Unrealised foreignexchange loss / (gain)

4,094

(1,131)

Gainondisposal of property, plant andequipment

–

(1)

Impairment of goodwill

–

7,551

Operatingcash flowsbeforeworkingcapital changes

(5,697)

(751)

Increase in inventories andwork-in-progress

(14,536)

(34,840)

Decrease ingross amount due fromcustomers for contractwork-in-progress

978

5,667

Decrease ingross amount due tocustomers for contractwork-in-progress

(18)

(1,459)

Decrease in trade andother receivables

2,657

5,628

Decrease / (increase) inprepaidoperatingexpenses

75

(39)

Decrease in trade andother payables

(1,035)

(4,932)

Cash flowsused inoperations

(17,576)

(30,726)

Interest received

695

699

Income tax refunded / (paid)

518

(196)

Net cash flowsused inoperatingactivities

(16,363)

(30,223)

Cash flows from investingactivities

Purchaseof property, plant andequipment

(689)

(1,998)

Proceed fromdisposal of property, plant andequipment

–

1

Additions to intangible asset

(16)

(105)

Maturityof investment securities

2,993

3,713

Purchaseof investment securities

(302)

(315)

Net cash flows from investingactivities

1,986

1,296

Cash flows from financingactivity

Dividends paidonordinary shares

(2,536)

(5,072)

Net cash flowsused in financingactivity

(2,536)

(5,072)

Net decrease incash andcashequivalents

(16,913)

(33,999)

Effect of exchange ratechanges oncash andcashequivalents

(3,401)

885

Cash andcashequivalents at beginningof financial year

106,956

140,070

Cashandcashequivalentsat endof financial year (Note19)

86,642

106,956

CONSOLIDATED

CASHFLOW STATEMENT

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2017

The accompanying accountingpolicies andexplanatorynotes form an integral part of the financial statements.