45

BAKERTECHNOLOGYLIMITED

ANNUALREPORT2013

Financial Review

reap

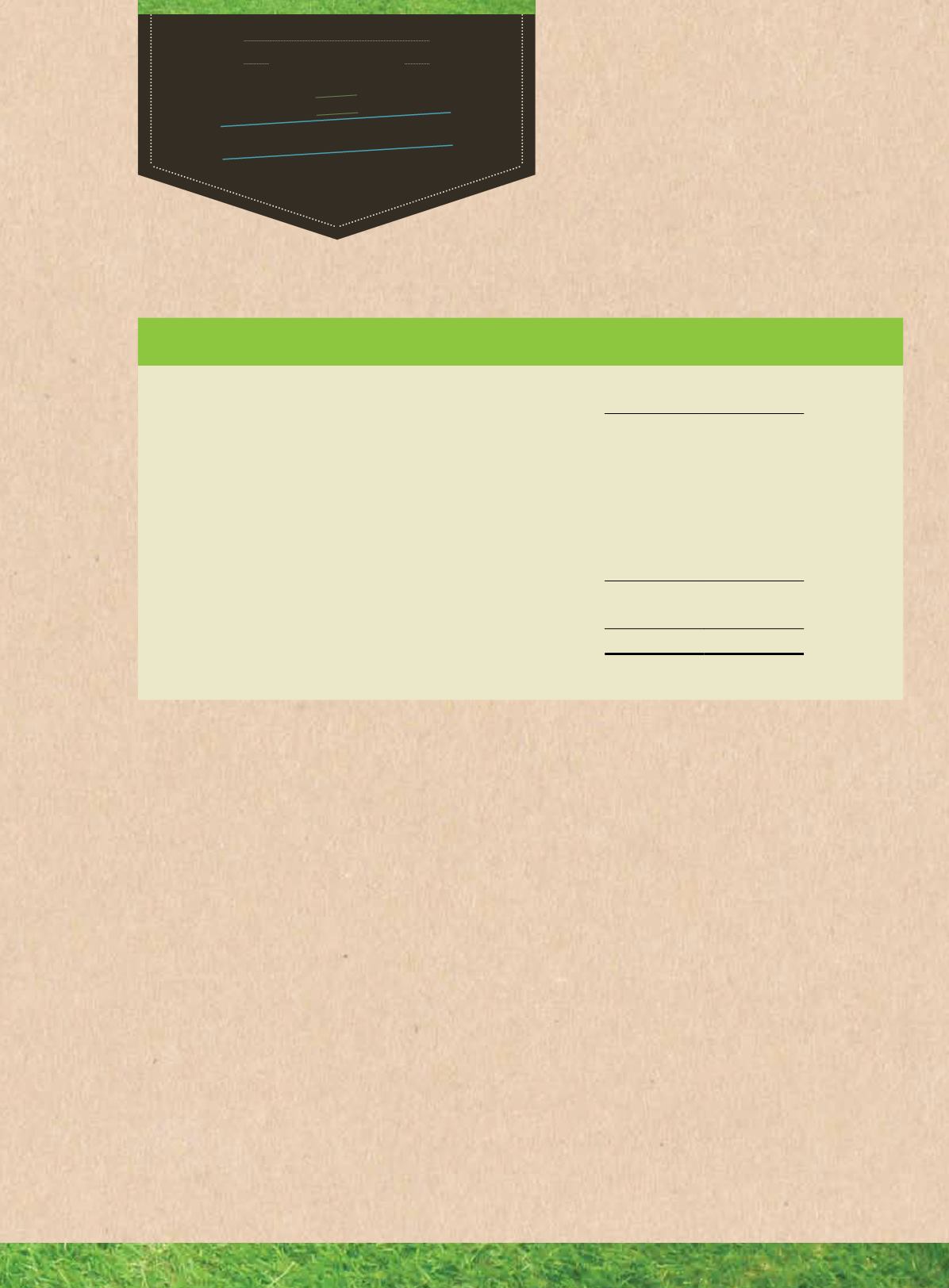

Income Statement

2013

2012

Changes

$'000

$'000

%

Revenue

83,299

98,244

-15%

Cost of goods sold

(59,531)

(73,160)

-19%

Gross profits

23,768

25,084

-5%

Other operating income / (expenses), net

1,871

(173)

NM

Administrative expenses

(7,813)

(9,708)

-20%

Finance costs

(8)

(122)

-93%

Share of results of associates

(495)

587

NM

Gainondisposal of associates

8,757

10,894

-20%

Recognitionof deferredgain fromdisposal of subsidiary (PPLH)

-

58,237

NM

Profit before tax

26,080

84,799

-69%

Income tax expenses

(3,707)

(3,208)

16%

Profit after tax

22,373

81,591

-73%

Gross ProfitMargin

29% 26%

The 15% reduction inGroup revenuewasmainly attributable to the slowdown of order intake from July 2012 to June 2013,

and lower contribution from newer projects secured in FY2013. Despite the reduction in revenue, gross profit decreased by

only 5%due to bettermargins resulting from improvements in production efficiency.

Pre-tax profit was significantly lower compared to FY2012mainly due to lower investment gains in FY2013. In FY2013, the

Group recorded a gain of $8.8million on the disposal of its stake in Discovery Offshore S.A. In comparison, FY2012 pre-tax

profit included the recognition of a deferred gain of $58.2million from the sale of the stake in PPL Holdings Pte Ltd (‘PPLH”),

and a $10.9million gainon disposal of York Transport Equipment (Asia) Pte Ltd (“York”).

The decrease in pre-tax profit was partially offset by a reduction in administrative expenses, mainly due to lower payroll

costs and lower legal fees due to the conclusion of the legal suit inMay 2012. The Group’s key operating subsidiary in the

marineoffshore segment, SeaDeep,maintained its healthy contribution to theGroup’s earnings, contributingpre-tax profit of

$20.3million. Thiswas amarginal increase from$20.0million in 2012.

Other operating incomewasboostedbya foreignexchangegainof $1.6milliondue to the strengtheningof both theUSdollar

and the Euro against the Singapore dollar.

The Group’s effective tax rate for FY2013was 14% compared to 4% in FY2012. These rates were lower than the statutory

income tax rateof 17% inSingapore, as the substantial gains from thedisposalsof subsidiary / associateswere capital innature

and thus not subjected to tax.

As a result of the above factors, theGroup’s net profit reduced73% to$22.4million in FY2013. Basic earnings per sharewere

2.7 cents for FY2013, compared to 11.5 cents in FY2012. Fully diluted earnings per sharewere 2.4 cents, after adjusting for

the dilutive effect of approximately 145millionwarrants outstanding.