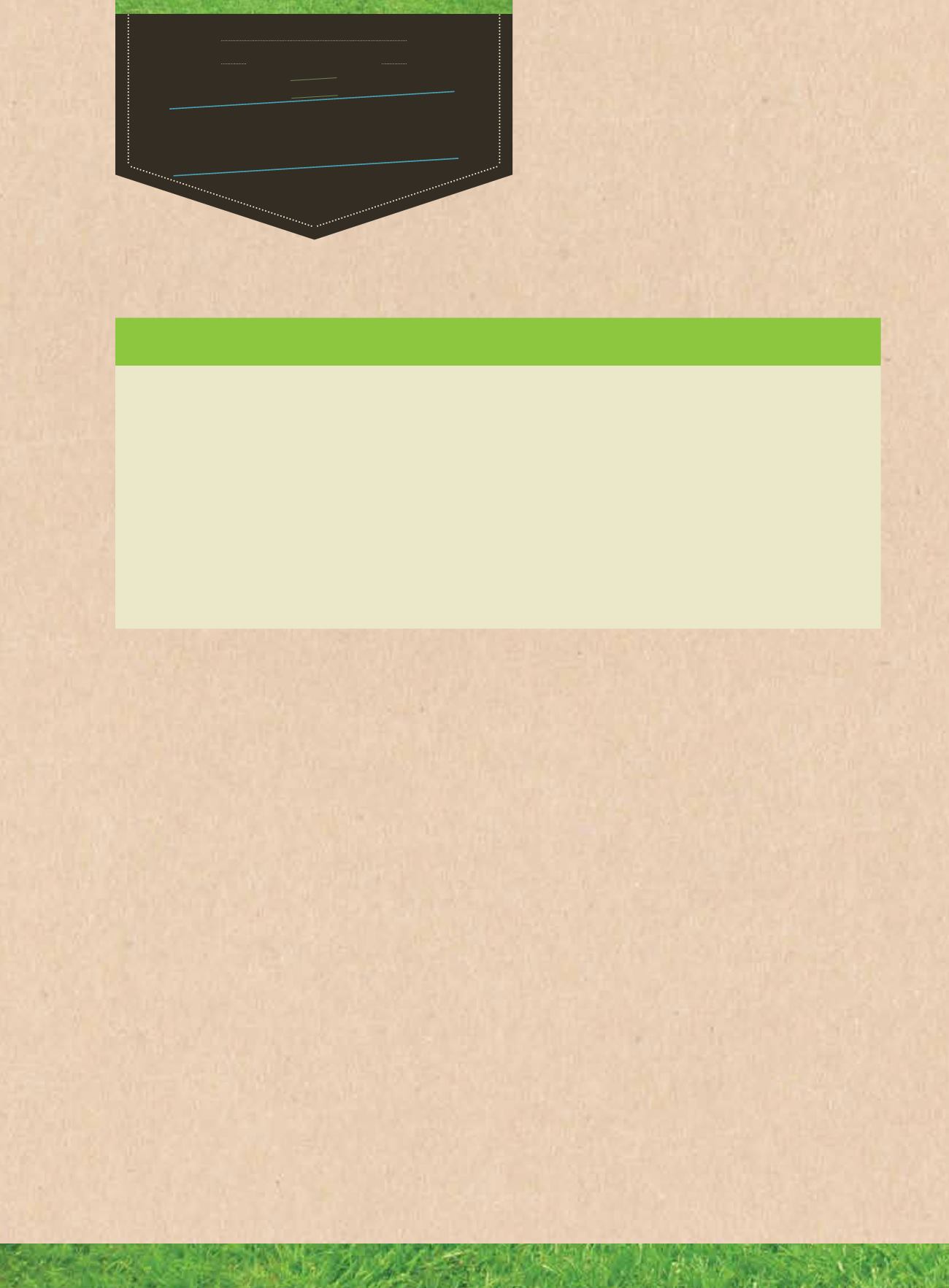

50

BAKERTECHNOLOGYLIMITED

ANNUALREPORT2013

reap

Five-Year

PerformanceReview

2013

2012

2011

2010

2009

$'000

$'000

$'000

$'000

$'000

Revenue

83,299

98,244

81,147

48,427

79,245

Gross profit

23,768

25,084

23,510

24,931

51,299

Pre-tax profit

26,080

84,799

10,630

30,389

96,130

Pre-tax profit*

17,818

15,081

10,877

14,177

40,970

Net profit

22,373

81,591

7,631

27,401

88,580

Shareholders' equity

239,843

268,143

171,791

187,133

166,285

Loans andborrowings

-

3,678

-

99

145

Cash and short-term deposits

205,871

173,902

169,277

214,130

76,428

Earnings per share (Cents)

2.7

11.5

1.1

4.1

13.9

Diluted Earnings per share (Cents)

2.4

8.3

0.8

2.8

13.8

* - Excluding share of results from joint venture& associates andgains fromdisposal of subsidiary / associates.

2009

2009 was the first full year of contribution from Sea Deep Shipyard Pte. Ltd. (“Sea Deep”) following its acquisition in April

2008. However, group revenue increased only marginally to $79.3 million due to the slowdown of activities in the marine

offshore sector following the onset of the global financial crisis. Credit availability had been affected by the global credit

crunch, leading to delays in the finalisation of a number of offshore projects. As a result, theGroup’s net order book fell to a

low of US$7million as at December 2009, fromUS$57million a year prior.

However, as theGrouphad securedanumber of high value specialised steel structureprojects inprevious years, highermargins

were recognised in thefinal stages as theprojects neared completion. This resulted in a significant increase ingross profit from

$21.9million in2008 to$51.3million in2009. Coupledwith a strongperformance from PPL Shipyard Pte Ltd (“PPLS”),where

the Group’s 15% share of profits amounted to $55.4million, the Group’s pre-tax profit surged to a record $96.1million for

the year.

2010

The Group continued to weather the effects of the global financial crisis. Revenue decreased from $79.2 million to $48.4

millionas a result of slower order intake in2009.Correspondingly, grossprofit dropped to$24.9million.Over the courseof the

year, however, activities in the oil and gas industry started picking up and theGroup’s order book began to strengthen again.

As of December 2010, the order book had recovered toUS$33million.

Most notably, theGroup sold its stake in PPLHoldings Pte Ltd (“PPLH”) during the year for US$116.25million ($150.5million).

However, due to the ensuing legal suit between PPLH and Sembcorp Marine Ltd (“SCM”) over the disposal, the gain on

disposal of $58.2millionwas deferred until the final rulingwas passed in2012.

As a result of lower contributions from Sea Deep and a lower share of results from PPLH, pre-tax profit decreased from

$96.1million to $30.4million in 2010. However, following the completion of the disposal of PPLH, theGroup’s cash position

improved significantly from $76.4million to $214.1million.