Notestothefinancialstatements

For the financial year ended31December 2015

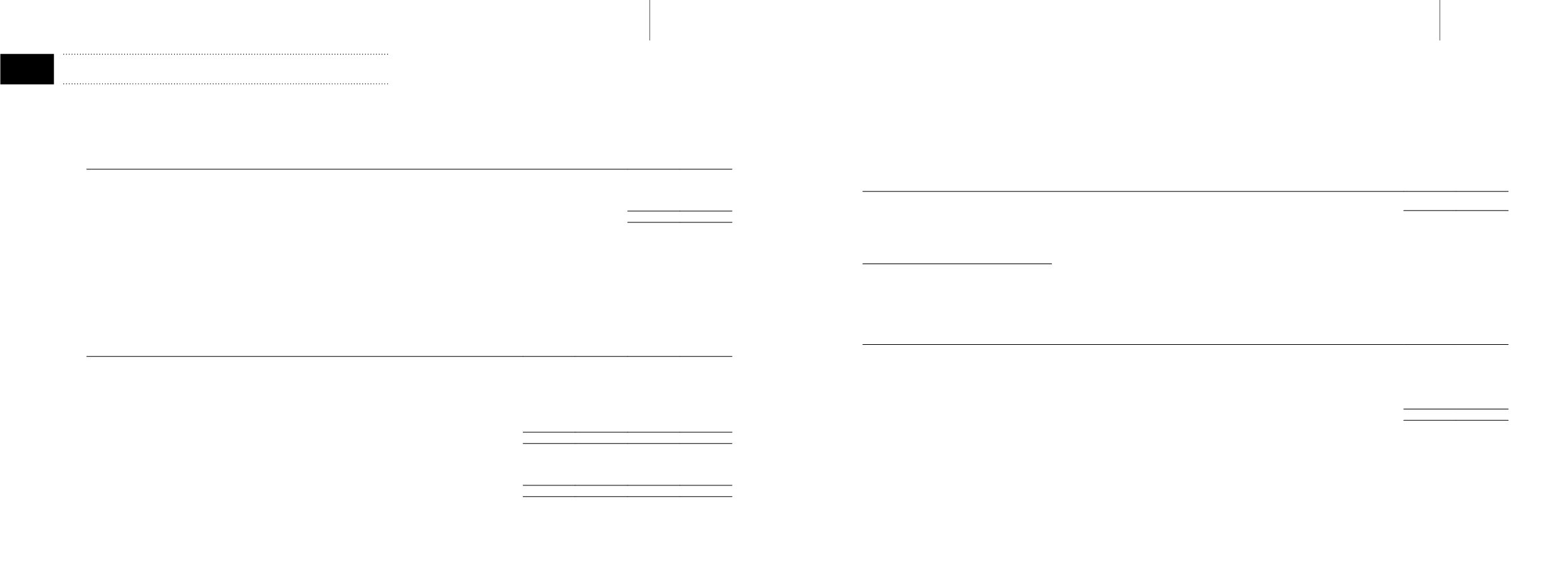

16.

Inventoriesandwork-in-progress

Group

2015

2014

$’000

$’000

Balancesheet:

Materials, componentsand spares

2,915

2,512

Work-in-progress

47,114

9,066

50,029

11,578

The cost of the goods sold reported in the statement of comprehensive income substantially relates tomaterials, components and spares recognised as an

expense for the year including inventorieswrittendownamounting to$625,000 (2014: $1,950,000).

Work-in-progress relates to the cost of directmaterials, direct labour and costs incurred in connectionwith theLiftboat project.

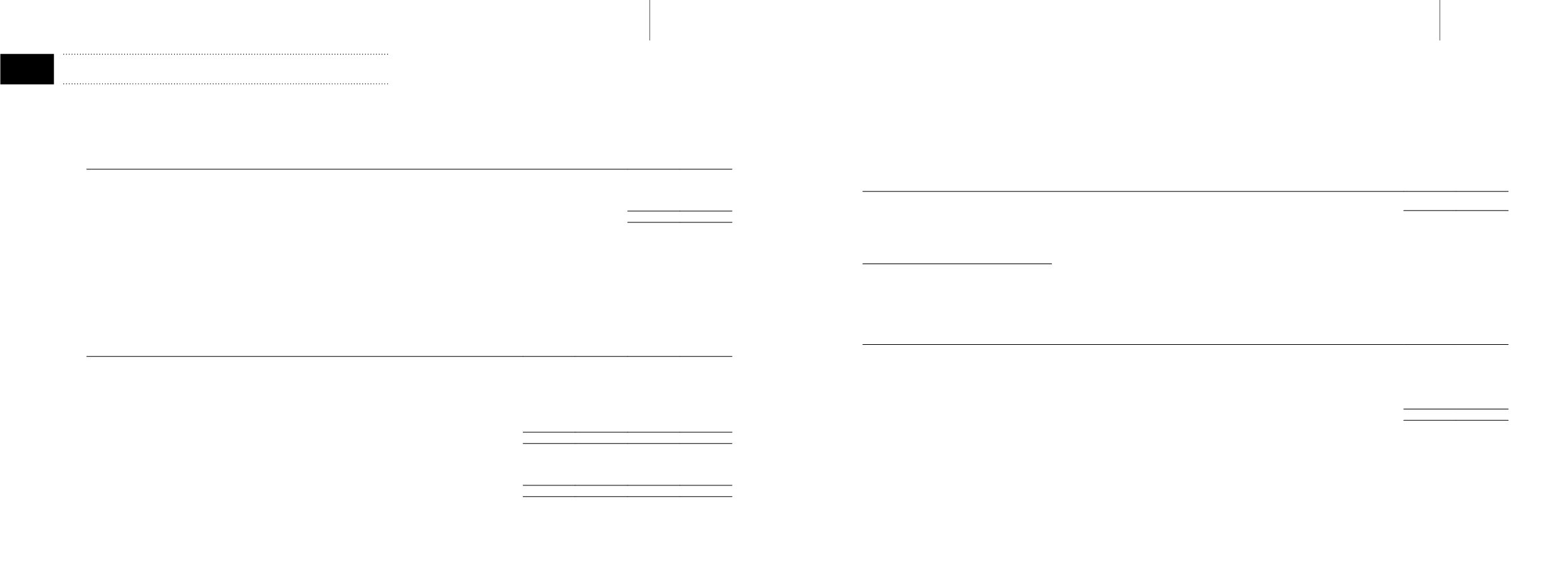

17.

Tradeandother receivables

Group

Company

2015

2014

2015

2014

$’000

$’000

$’000

$’000

Trade receivables

8,013

5,848

–

–

Deposits

231

365

–

–

Downpayment for capital expenditure

120

800

–

–

GST recoverable

2,511

464

–

–

Sundry receivables

255

3

–

–

Interest receivables

117

111

117

111

Total tradeandother receivables

11,247

7,591

117

111

Tradeandother receivables (excludingGST recoverableanddownpayment for capital expenditure)

8,616

6,327

117

111

Amount due from subsidiaries (Note18)

–

–

67,166

6,011

Cashand short-termdeposits (Note19)

140,070

168,685

128,265

136,570

Total loansand receivables

148,686

175,012

195,548

142,692

Trade receivables are non-interest bearing and are generally on 30 to 90 days’ terms. They are recognised at their original invoiced amountswhich represent

their fair valueson initial recognition.

17.

Tradeandother receivables (cont’d)

TheGroup’s trade receivablesdenominated in foreign currenciesat 31December areas follows:

Group

2015

2014

$’000

$’000

UnitedStatesDollar

8,013

5,807

At the end of the reporting period, trade receivable amounting to $Nil (2014: $1,673,000) was arranged to be settled via letter of credits issued by a reputable

bank in the countrywhere the customerwasbased.

Receivables that arepast duebut not impaired

The Group has trade receivables amounting to $1,739,000 (2014: $1,925,000) that are past due at the end of the reporting period but not impaired. These

receivablesareunsecuredand theanalysisof their agingat theendof the reportingperiod isas follows:

Group

2015

2014

$’000

$’000

Trade receivablespast duebut not impaired:

Lesser than30days

231

131

30 to60days

949

363

61 to90days

20

126

More than90days

539

1,305

1,739

1,925

Of the trade receivables of $539,000 (2014: $1,305,000) which was past due for more than 90 days, $Nil (2014: $672,000) relates to retention sums on

construction contracts.

114

115

BAKERTECHNOLOGYlimited

ANNUAL REPORT 2015