Notes to the

financial statements

For the financial year ended 31 December 2018

119

A N N U A L R E P O R T

2 0 1 8

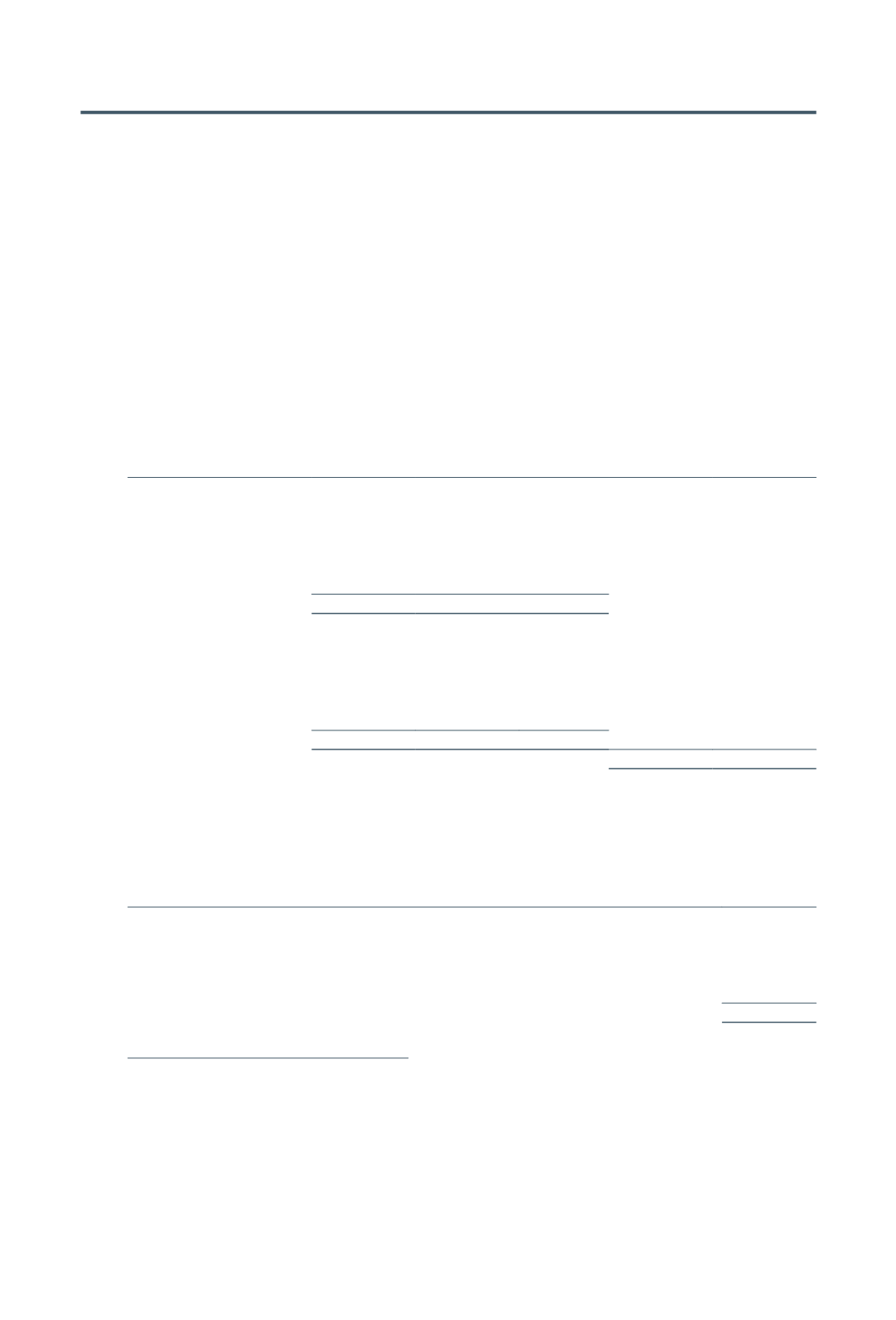

16.

Deferred tax

Deferred tax as at 31 December relates to the following:

Group

Consolidated balance sheet

Consolidated statement

of comprehensive income

31.12.2018

31.12.2017 1.1.2017

31.12.2018

31.12.2017

$’000

$’000 $’000

$’000

$’000

Deferred tax assets:

Provisions

–

20

252

20

232

Differences in

depreciation for tax

purposes

–

(3)

(4)

(3)

(1)

–

17

248

Deferred tax liabilities:

Provisions

–

45

75

45

30

Differences in

depreciation for tax

purposes (Note A)

(5,545)

(89)

(530)

76

(441)

(5,545)

(44)

(455)

Deferred tax expense

138

(180)

Note A: The movement of deferred tax liabilities arising from differences in depreciation for tax

purposes for the financial year ended 31 December 2018 is summarised as follows:

Group

31.12.2018

$’000

Beginning of the year

89

Acquisition of a subsidiary

5,403

Charged to consolidated statement of comprehensive income

76

Translation difference

(23)

5,545

Tax consequence of proposed dividends

There are no income tax consequences (2017: Nil) attached to the dividends proposed by the

Company to the shareholders but not recognised as a liability in the financial statements (Note 30).