122

123

BAKER TECHNOLOGY LIMITED ANNUAL REPORT 2012

BAKER TECHNOLOGY LIMITED ANNUAL REPORT 2012

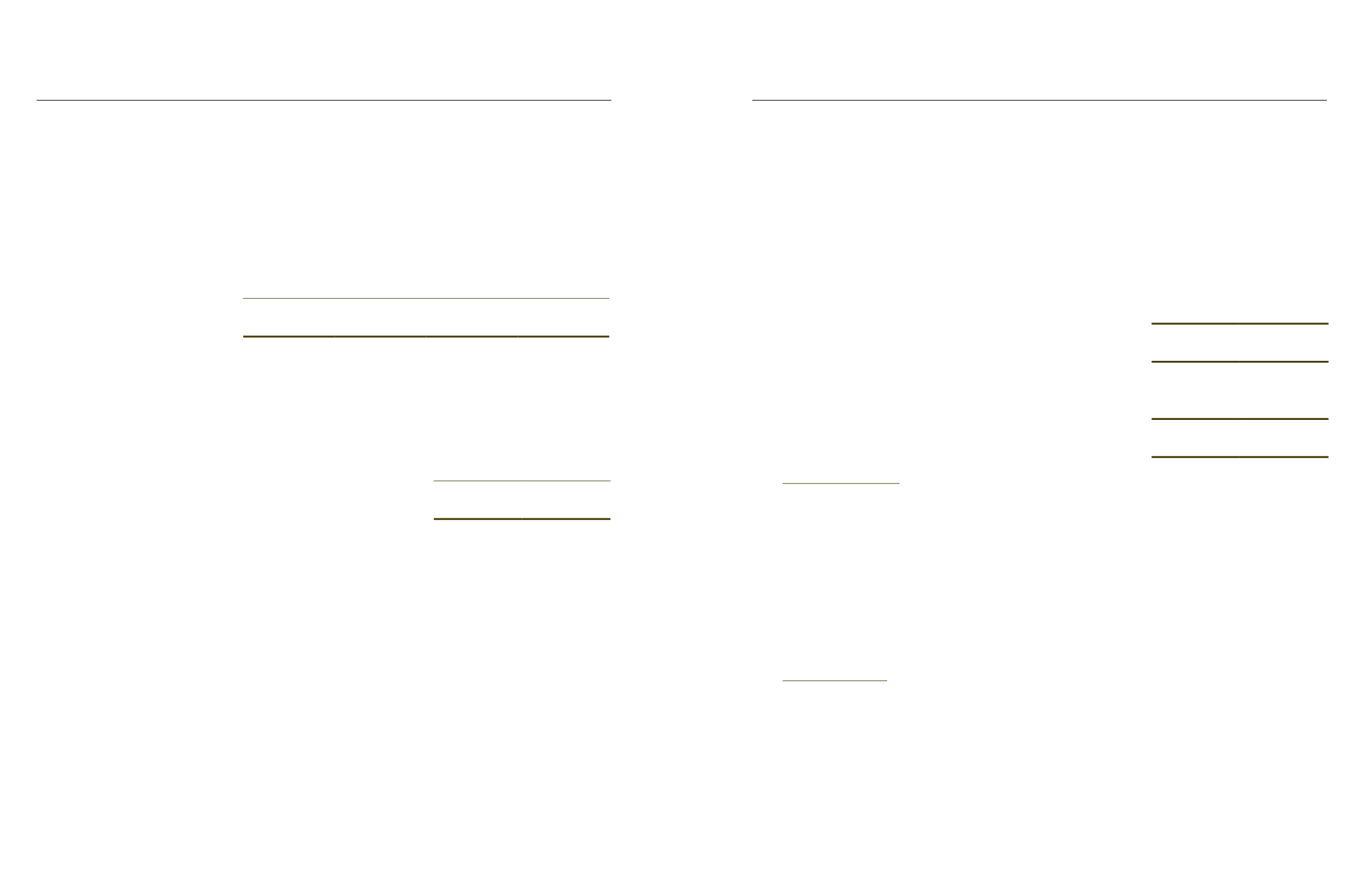

14. Investment inassociates

Group

Company

2012

2011

2012

2011

$

$

$

$

Shares, at cost

32,030,623

9,616,388 32,030,623

9,616,388

Share of post-acquisition reserves

(11,000)

742,035

–

–

32,019,623 10,358,423 32,030,623

9,616,388

The carrying cost of the investment in associates is represented by:

Group

2012

2011

$

$

Share of net assets

29,659,623 10,358,423

Goodwill on acquisition

2,360,000

–

32,019,623 10,358,423

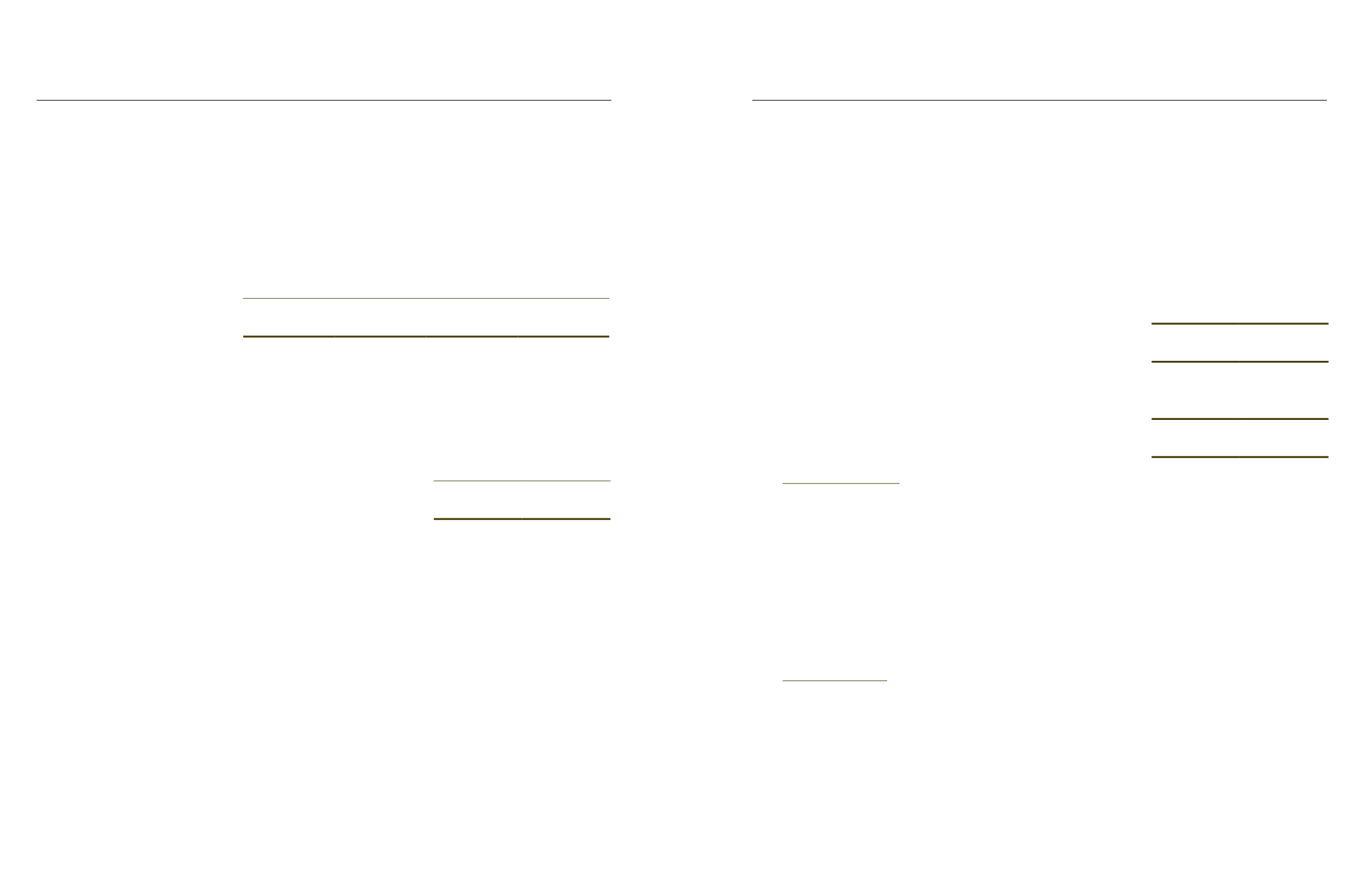

Associates

(Country of incorporation)

Percentage of

equity held

by theGroup

Principal activity

2012 2011

% %

(1)

York Transport Equipment (Asia) Pte Ltd

(Singapore)

–

49 Production and distribution of

axles and related components

(2)

DiscoveryOffshore S.A.

(Luxembourg)

20

– Ownership of jack-up rigs to serve

customers in the exploration and

production sector

(1)

Audited by Ernst & Young LLP, Singapore

(2)

Audited by Ernst & Young LLP, Luxembourg

14. Investment inassociates (cont’d)

The summarised financial information of the associates, not adjusted for the proportion of ownership interest

held by theGroup, is as follows :

Group

2012

2011

$

$

Assets and liabilities :

Total assets

149,609,810 55,709,849

Total liabilities

3,292,684 36,824,979

Results :

Revenue

– 85,454,740

Net loss for the year

(1,919,038)

(503,890)

Acquisition of associate

During the current financial year, theCompany purchased additional 2,060,513 shares in DiscoveryOffshore

S.A. (“DO”) from the open market for a total consideration of $4,412,595. As a result, the Company now

holds approximately20% in the issued share capital of DO. TheCompany has also re-designated its investment

in DO from that of an available-for-sale investment to an associate.

DO was incorporated on 12 January 2011 with the purpose of owning new ultra high-specification jack-up

drilling rigs. Itsmain assets are two high specification jack-up drilling rigs that are currently under construction,

with delivery scheduled in year 2013. The shares of DOwere listed on theOslo Axess Stock Exchange since

2May 2011. As at 31 December 2012, the fair value of instrument in DO for which there is published price

quotationwas approximately $31,947,000.

Disposal of associate

TheCompany had entered intoaCall and PutOptionsAgreement on5October 2007with TRF Limited (“TRF”),

the other 51% shareholder of York Transport Equipment (Asia) Pte Ltd (“York”) for its remaining 49% stake in

York.

Under the agreement, theCompany had granted a call option to TRF and TRF had also granted a put option to

the Company, which when exercised, the Company will sell its remaining 49% stake in York to TRF at a base

price of $18,425,000 plus 49% of the consolidated undistributed net profit of York from1 January 2008. The

Company will receive an additional amount of equal to 15% of $18,425,000 if the call option is exercised.

TheCompany did not prescribe any value to these call and put options since the date of inception.

for the financial year ended 31december 2012

for the financial year ended 31december 2012

notestothe

financialstatements

notestothe

financialstatements