138

139

BAKER TECHNOLOGY LIMITED ANNUAL REPORT 2012

BAKER TECHNOLOGY LIMITED ANNUAL REPORT 2012

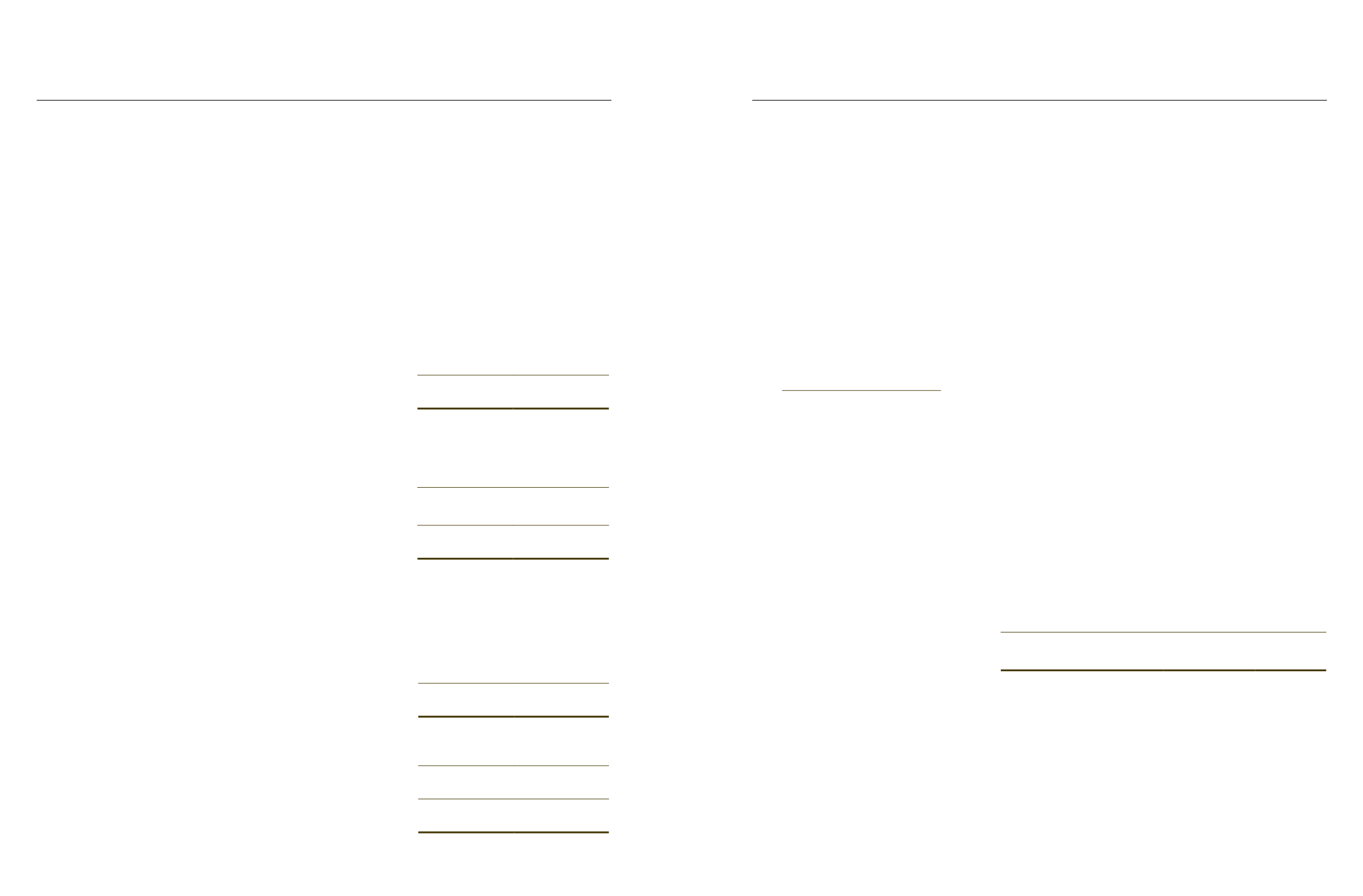

30. Financial riskmanagementobjectivesand policies (cont’d)

Liquidity risk (cont’d)

2012

2011

Group

One year or

less

One year or

less

$

$

Financial assets:

Trade and other receivables

19,121,183

9,875,680

Pledged deposits

11,067,427

6,500,000

Cash and short-term deposits

173,901,562 169,276,813

Total undiscounted financial assets

204,090,172 185,652,493

Financial liabilities:

Trade and other payables

12,531,798 25,297,476

Loans and borrowings

3,678,049

–

Total undiscounted financial liabilities

16,209,847 25,297,476

Total net undiscounted financial assets

187,880,325 160,355,017

Company

Financial assets:

Trade and other receivables

167,652

22,223

Amount due from subsidiaries

2,700,000

600,000

Cash and short-term deposits

167,789,758 142,122,891

Total undiscounted financial assets

170,657,410 142,745,114

Financial liabilities:

Trade and other payables

3,139,566

1,564,475

Total undiscounted financial liabilities

3,139,566

1,564,475

Total net undiscounted financial assets

167,517,844 141,180,639

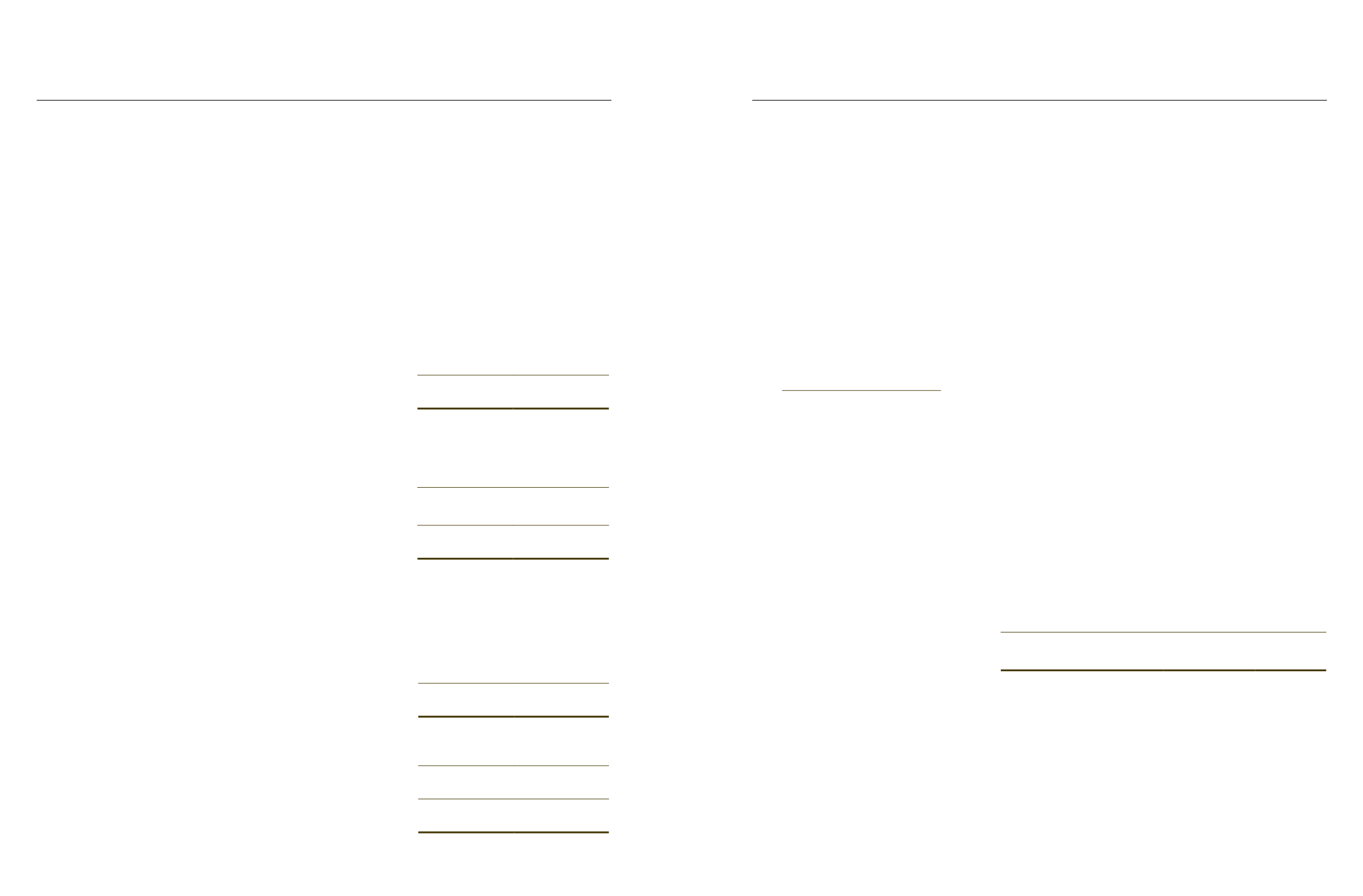

30. Financial riskmanagementobjectivesand policies (cont’d)

Credit risk

Credit risk is the risk of loss that may arise on outstanding financial instruments shoulda counterparty default on

its obligations. TheGroup’s exposure to credit risk arises primarily from trade and other receivables. For other

financial assets (including cash and cash equivalents), the Group minimises credit risk by dealing exclusively

with high credit rating counterparties.

The Group’s objective is to seek continual revenue growth while minimising losses incurred due to increased

credit risk exposure. The Group trades only with recognised and creditworthy third parties. It is the Group’s

policy that all customers who wish to trade on credit terms are subject to credit verification procedures. In

addition, receivable balances are monitored on an ongoing basis with the result that the Group’s exposure to

bad debts is not significant.

Credit risk concentration profile

The Group determines concentrations of credit risk by monitoring the country profile of its trade receivables

on an ongoing basis. The credit risk concentration profile of the Group’s trade receivables at the end of the

reporting period is as follows:

Group

By country

2012

$

% of

total

2011

$

% of

total

Singapore

6,598,194

36

1,348,552

14

China

10,262,496

56

4,687,553

49

Middle East

172,424

1

568,663

6

Asia Pacific (excluding

China and Singapore)

1,210,645

7

3,037,042

31

18,243,759

100

9,641,810

100

At the end of the reporting period, approximately:

-

97% (2011: 90%) of theGroup’s trade receivables were due from 5 (2011: 5) major customers who are

located in Singapore andChina.

-

A nominal amount of $39,040,000 (2011: $23,400,000) relating to a corporate guarantee provided by

theCompany to banks for its subsidiaries’ banking facilities.

for the financial year ended 31december 2012

for the financial year ended 31december 2012

notestothe

financialstatements

notestothe

financialstatements