130

131

BAKER TECHNOLOGY LIMITED ANNUAL REPORT 2012

BAKER TECHNOLOGY LIMITED ANNUAL REPORT 2012

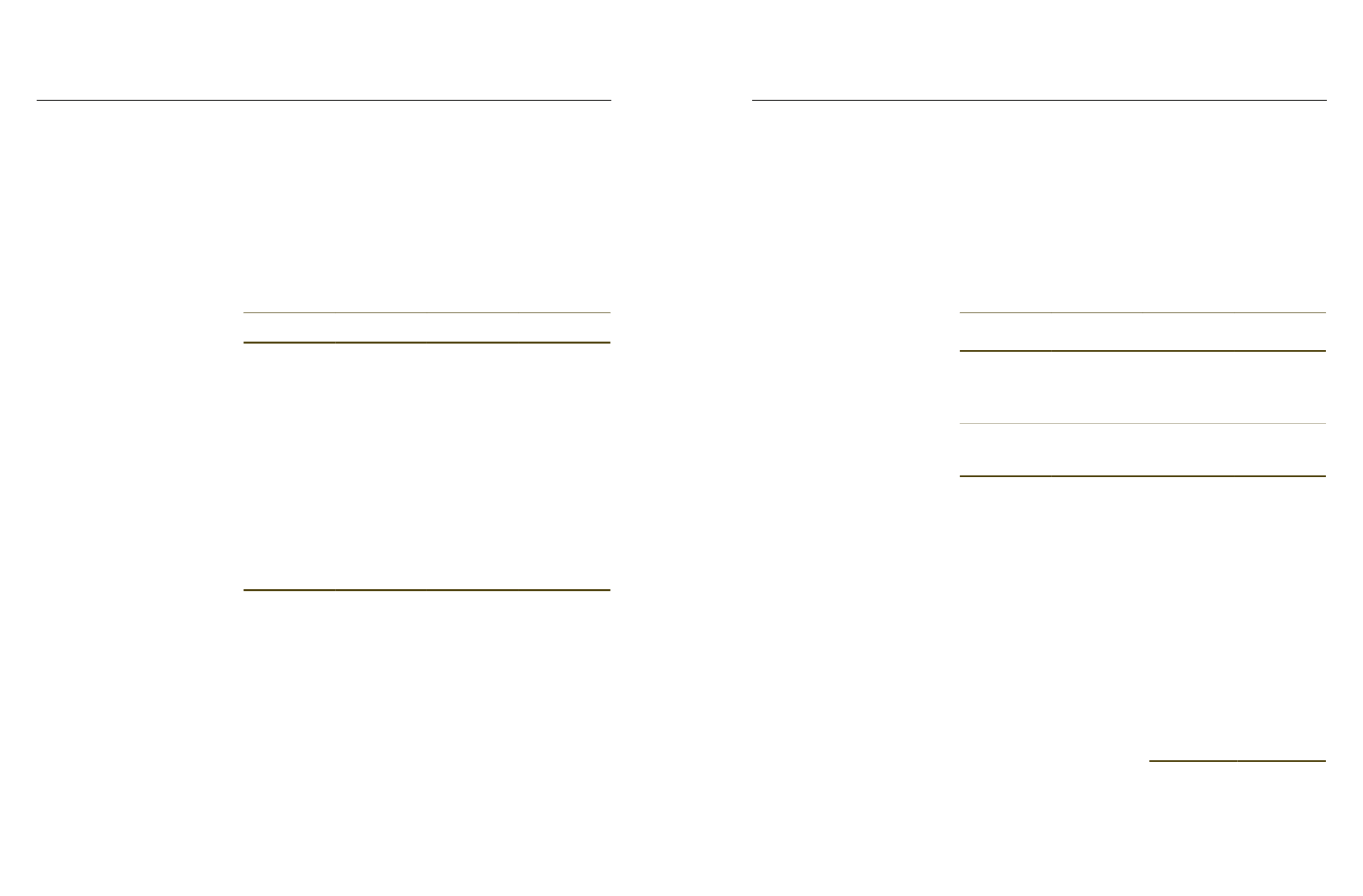

22. Cashand short-termdeposits

Group

Company

2012

2011

2012

2011

$

$

$

$

Cash at banks and in hand

100,555,589 127,244,008 94,443,785 100,090,086

Short term deposits

73,345,973 42,032,805 73,345,973 42,032,805

173,901,562 169,276,813 167,789,758 142,122,891

Cash at banks earns interest at floating rates based on daily bank deposit rates. Short-term deposits aremade

for varyingperiods of between oneweek to threemonths dependingon the immediate cash requirements of the

GroupandCompany, andearn interests at the respective short-termdeposit rates ranging from0.01% to0.41%

(2011: 0.07% to 0.55%) per annum.

Cash and short-term deposits denominated in foreign currencies at 31December are as follows:-

Group

Company

2012

2011

2012

2011

$

$

$

$

United States dollar

661,274 12,595,085

262,541

3,763,024

Euro

3,585,421

7,977,668

–

–

TheCompany has also provided a corporate guarantee for the subsidiaries’ banking facilities.

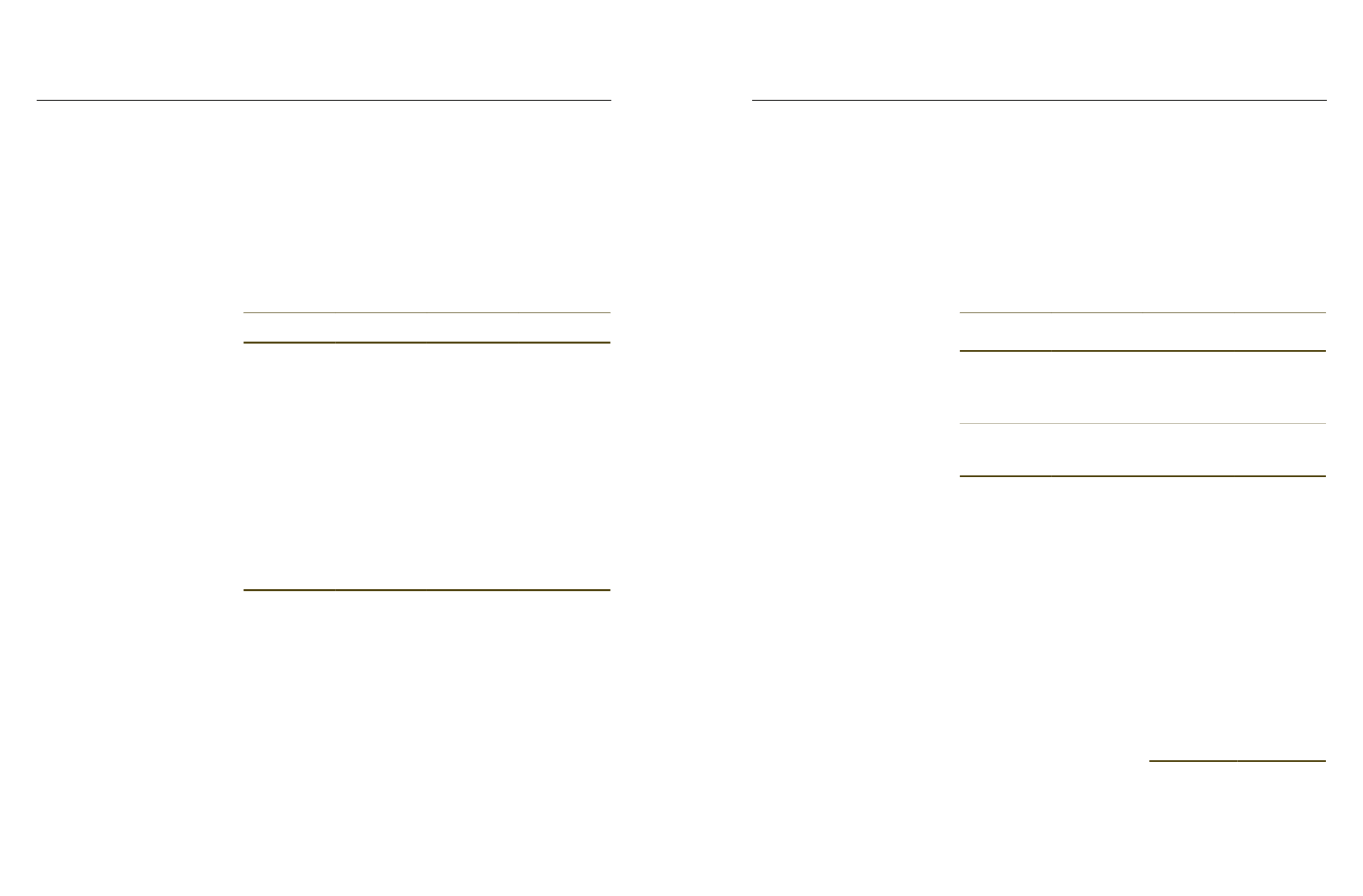

23. Loansand borrowings

This relates to short-term bank borrowings, denominated inUSD, drawn down by theCompany’s subsidiary for

working capital purposes. These borrowings bear interest rates ranging from1.93% to 2.33% per annum and

are secured by the subsidiary’s pledged deposits with the banks (Note 21).

24. Trade andother payables

Group

Company

2012

2011

2012

2011

$

$

$

$

Trade payables

6,993,743 20,894,872

–

–

Other payables

7,752,286

6,236,835

3,139,566

1,564,475

Total trade and other payables

14,746,029 27,131,707

3,139,566

1,564,475

Trade and other payables

excluding provision for warranty

12,531,798 25,297,476

3,139,566

1,564,475

Loans and borrowings (Note 23)

3,678,049

–

–

–

Total financial liabilities carried at

amortised cost

16,209,847 25,297,476

3,139,566

1,564,475

Trade payables are non-interest bearing and are normally settled on 30 to 90 days’ terms.

The Group’s other payables includes a provision for warranty of approximately $2,214,000 (2011:

$1,834,000). During thefinancial year, theGroupprovidedanadditional amount of approximately$380,000

(2011: wrote-back of $1,642,000). In line with the Group’s policy as discussed in Note 2.17, the additional

provision in 2012 andwrote-back in 2011 for warrantywere resulted from the annual revision.

Trade payables denominated in foreign currencies at 31December are as follows :-

Group

2012

2011

$

$

United States dollar

4,138,180 17,674,172

Euro

413,164

283,444

Australian dollar

–

53,222

for the financial year ended31december 2012

for the financial year ended 31december 2012

notestothe

financialstatements

notestothe

financialstatements