42

Baker Technology LimitedAnnual Report 2014

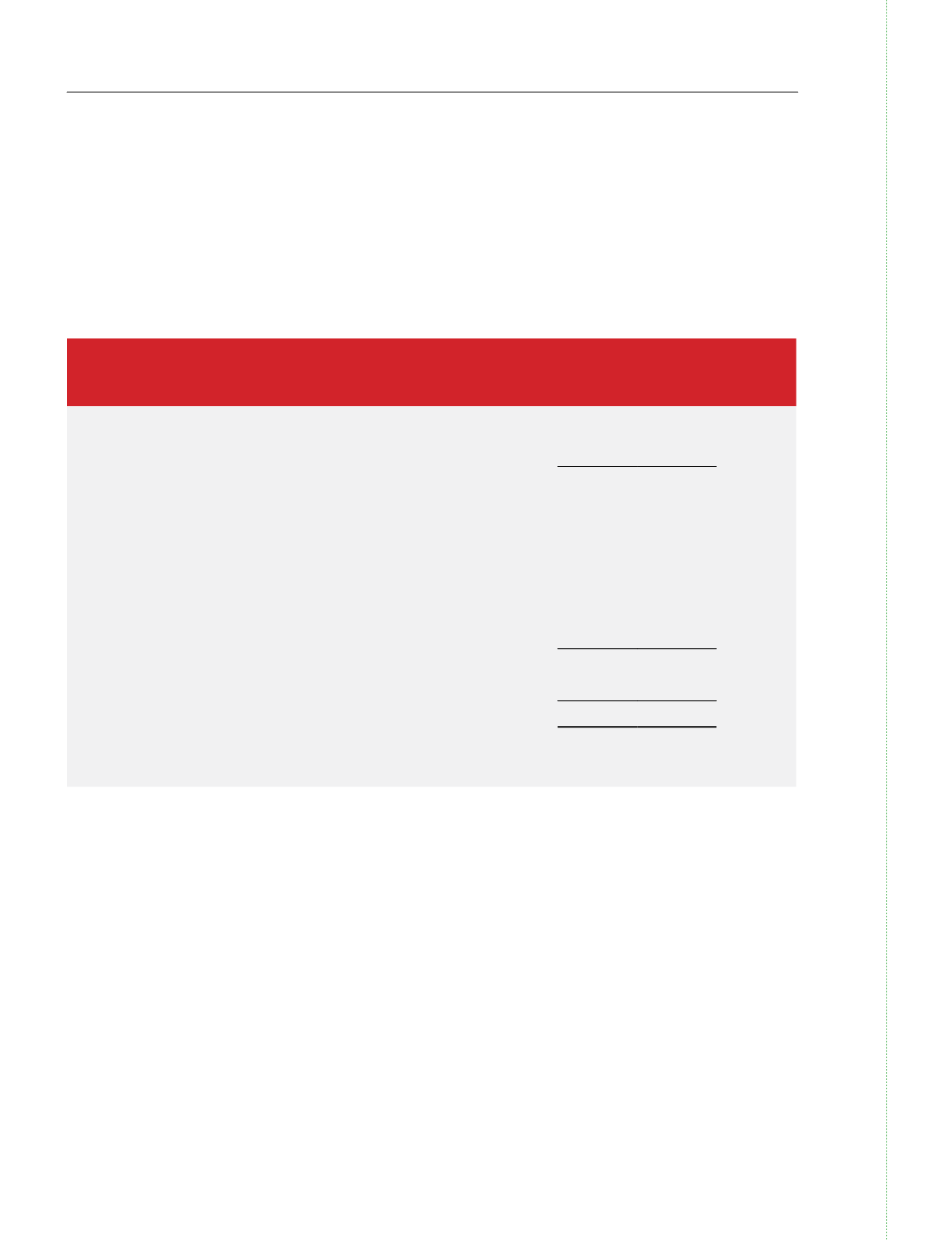

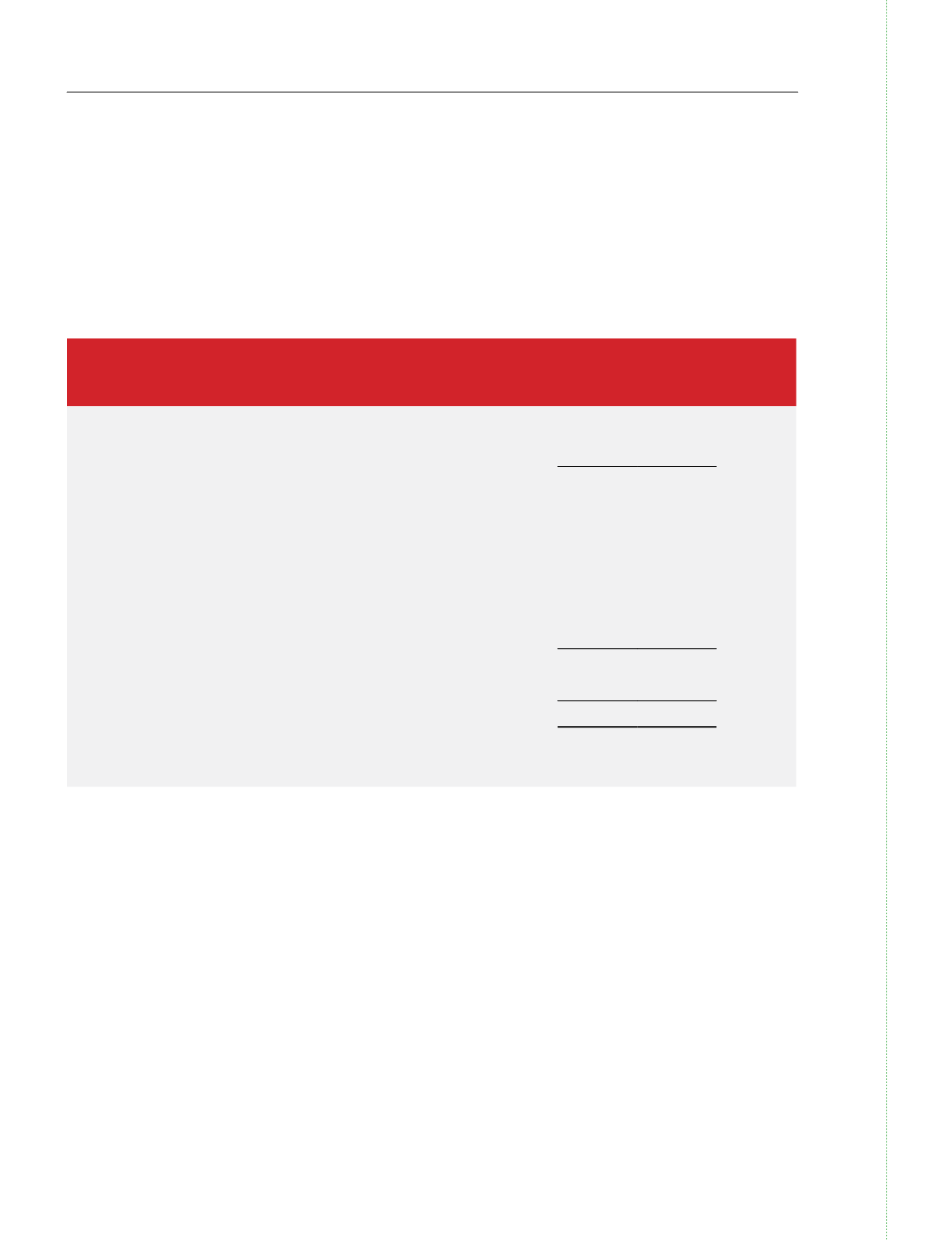

FINANCIAL

REVIEW

FINANCIALPERFORMANCE

2014

2013

%

$’000 $’000 Change

Revenue

86,272

83,299

+4%

Cost of sales

(63,566)

(59,531)

+7%

Gross profits

22,706

23,768

-4%

Other operating income / (expenses), net

4,642

1,871

+148%

Administrativeexpenses

(11,022)

(7,813)

+41%

Finance costs

-

(8)

-100%

Shareof results of an associate

-

(495)

-100%

Gainondisposal of an associate

-

8,757

-100%

Profit before tax

16,326

26,080

-37%

Income tax expenses

(2,809)

(3,707)

-24%

Profit after tax

13,517

22,373

-40%

Gross ProfitMargin

26%

29%

The 4% increase in Group revenue was due to higher progressive revenue recognition as a result of increased

shipments tocustomers. Pre-taxprofitwas significantly lower compared toFY2013mainlydue toan investment gain

of $8.8million from thedisposal of DiscoveryOffshoreS.A. inFY2013.

With the incorporation of new subsidiaries in the last financial year and the construction of the liftboat, theGroup

incurred higher administrative expenses of $3.2million. However, these increases were offset by foreign exchange

gainsduringFY2014asa result of the strengtheningof theUSdollarsagainst theSingaporedollars, especially in the

secondhalf of the year.

TheGroup’s effective tax rate for FY2014was 17% compared to 14% inFY2013. The FY2013 ratewas lower than the

statutory income tax rateof 17% inSingapore, as the investmentgain from thedisposal of anassociatewascapital in

natureandnot subject to tax. The factors above contributed toanet profit of $13.5million inFY2014. Basicearnings

per sharewere1.5cents for FY2014, compared to2.7cents inFY2013. Fullydilutedearningsper sharewere1.4cents,

after the adjustment for thedilutiveeffect of approximately 94millionwarrants outstanding.

The Directors have recommended a first and final tax-exempt (one-tier) dividend of 1.0 cent per share to be paid

for the year ended 31December 2014. This is subject to shareholders’ approval at the forthcomingAnnual General

Meetingof theCompany.