44

Baker Technology LimitedAnnual Report 2014

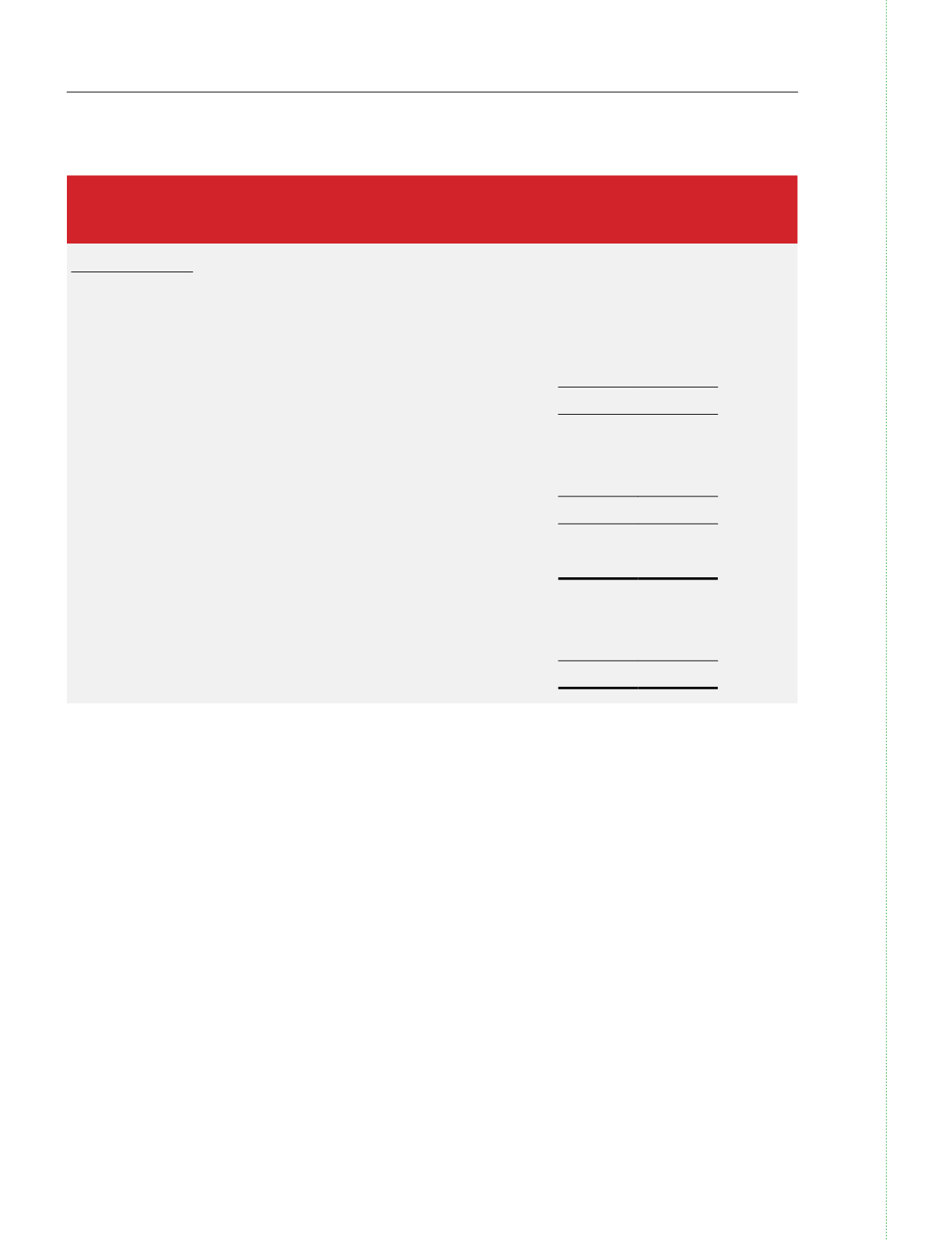

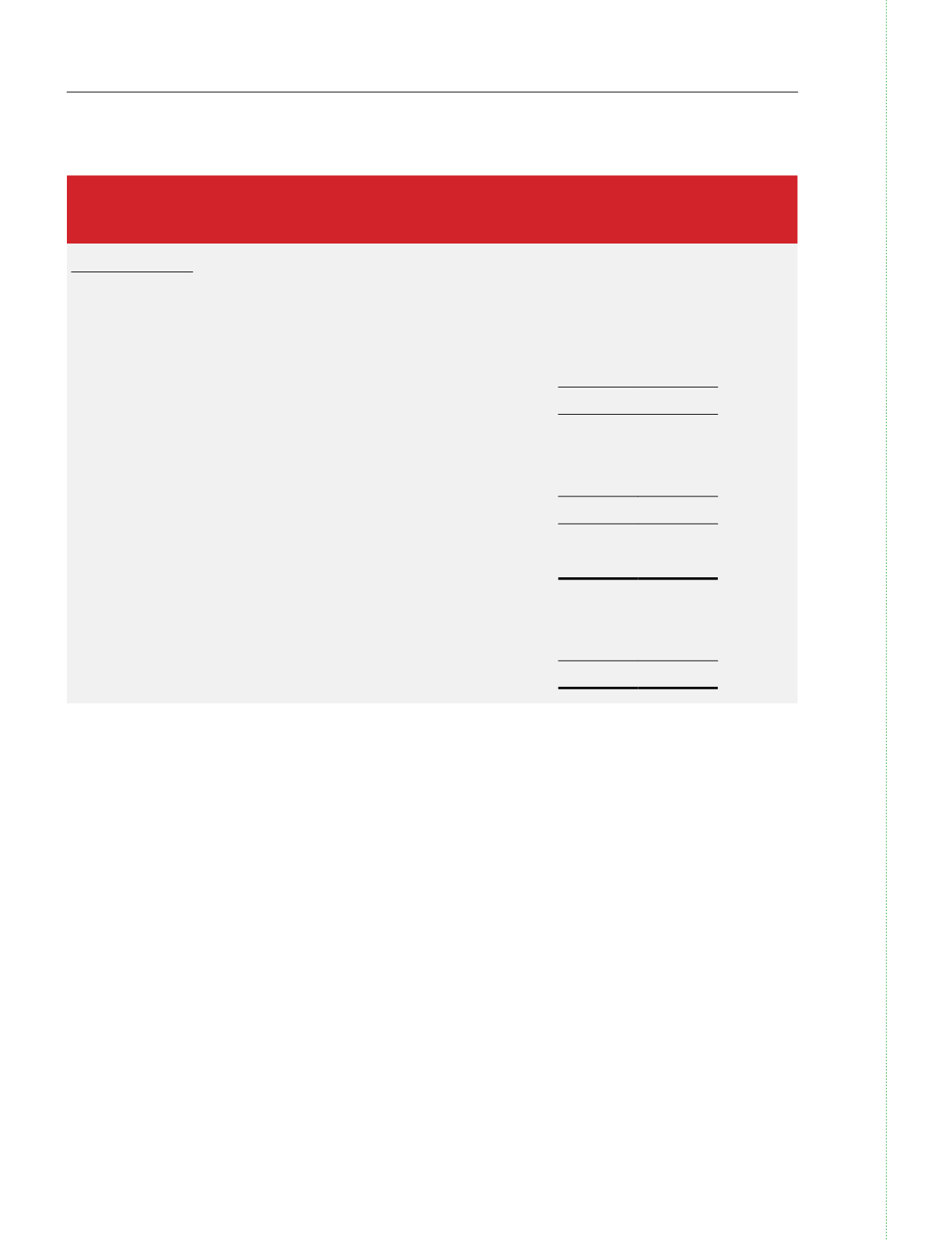

FINANCIALPOSITION

2014

2013

%

$’000 $’000 Change

Non-current assets

Property, plant andequipment

9,305

6,057

+54%

Intangible assets

9,764

7,551

+29%

Investment securities

8,288

2,456

+237%

Deferred tax assets

1,018

876

+16%

28,375

16,940

+68%

Current assets

207,674

239,229

-13%

Current liabilities

(19,148)

(16,326)

+17%

Net current assets

188,526

222,903

-15%

Net assets

216,901

239,843

-10%

Share capital

95,547

86,851

+10%

Reserves

121,354

152,992

-21%

Shareholders’ equity

216,901

239,843

-10%

TheGroup’snon-currentassets increasedmainlydue to theacquisitionofnewplantandmachineryby itssubsidiaries

to boost their production capabilities, the acquisition of liftboat designs and the purchase of quoted corporate

bonds toenhance its interest yield.

Current assets declined from $239.2million to $207.7million. Approximately 81% (or $168.7million) of theGroup’s

current assets is made up of cash and short-term deposits. Current liabilities saw an increase from $16.3 million

to $19.1million and this was in-line with the increase in production activities of theGroup’s operating subsidiaries

during the current year. TheGrouphad zerodebt as at 31December 2014.

Shareholders’ equitydecreasedby$22.9milliondue to thepayment of $45.2million individends to shareholders, and

thiswaspartiallyoffset by$8.7millionof proceeds from theconversionofwarrants, and retainedprofits for the year.

Asa result, theGroup’snet asset valueper share reduced from27.5centsat theendof 2013 to23.5centsbyend2014.