48

Baker Technology LimitedAnnual Report 2014

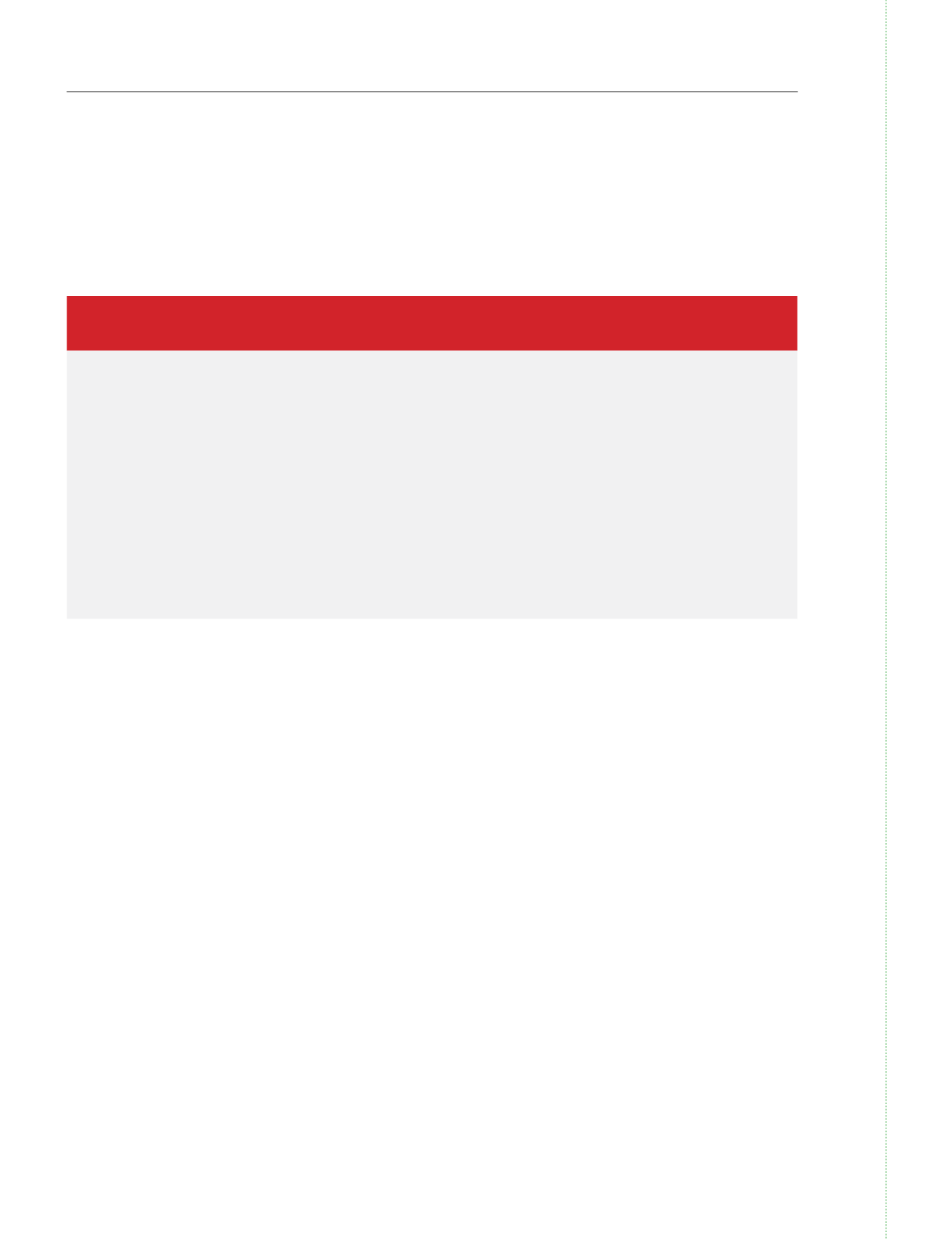

5-YEAR

PERFORMANCEREVIEW

2014

2013

2012

2011

2010

$’000 $’000 $’000 $’000 $’000

Revenue

86,272

83,299

98,244

81,147

48,427

Gross profit

22,706

23,768

25,084

23,510

24,931

Pre-taxprofit

16,326

26,080

84,799

10,630

30,389

Pre-taxprofit*

16,326

17,818

15,081

10,877

14,177

Net profit

13,517

22,373

81,591

7,631

27,401

Shareholders’ equity

216,901

239,843 268,143 171,791 187,133

Loans andborrowings

-

-

3,678

-

99

Cash and short-termdeposits

168,685

205,871 173,902 169,277 214,130

Earnings per share (Cents)

1.5

2.7

11.5

1.1

4.1

DilutedEarnings per share (Cents)

1.4

2.4

8.3

0.8

2.8

* -Excludingshareof results from joint ventures /associatesandgains fromdisposal of subsidiary /associates.

2010

Theglobal financial crisis threatenedmany companies but theGroupmanaged toweather through. Revenue saw a

decline from$79.2million to$48.4millionasa resultof slowerorder intake in2009withgrossprofitdeclining to$24.9

million. Over the course of 2010, activities in the oil and gas industry started to gainmomentum and theGroup’s

order bookbegan to strengthenagain. ByDecember 2010, theorder bookhad recovered toa steadyUS$33million.

During the year, theGroup sold its stake in PPL Holdings Pte Ltd (“PPLH”) an investment holding company which

owns a 15% stake in PPL Shipyard Pte Ltd, for US$116.25million ($150.5million). However, due to the ensuing legal

suit between PPLH and SembcorpMarine Ltd (“SCM”) over the disposal, the gain on disposal of $58.2millionwas

deferreduntil the final rulingwasmade in2012.

Asa resultof lower contributions fromSeaDeepanda lower shareof results fromPPLShipyardPteLtd,pre-taxprofit

decreased from$96.1million to$30.4million in2010.However, following thecompletionof thedisposal of PPLH, the

Group’s cashposition improved significantly from$76.4million to $214.1million.