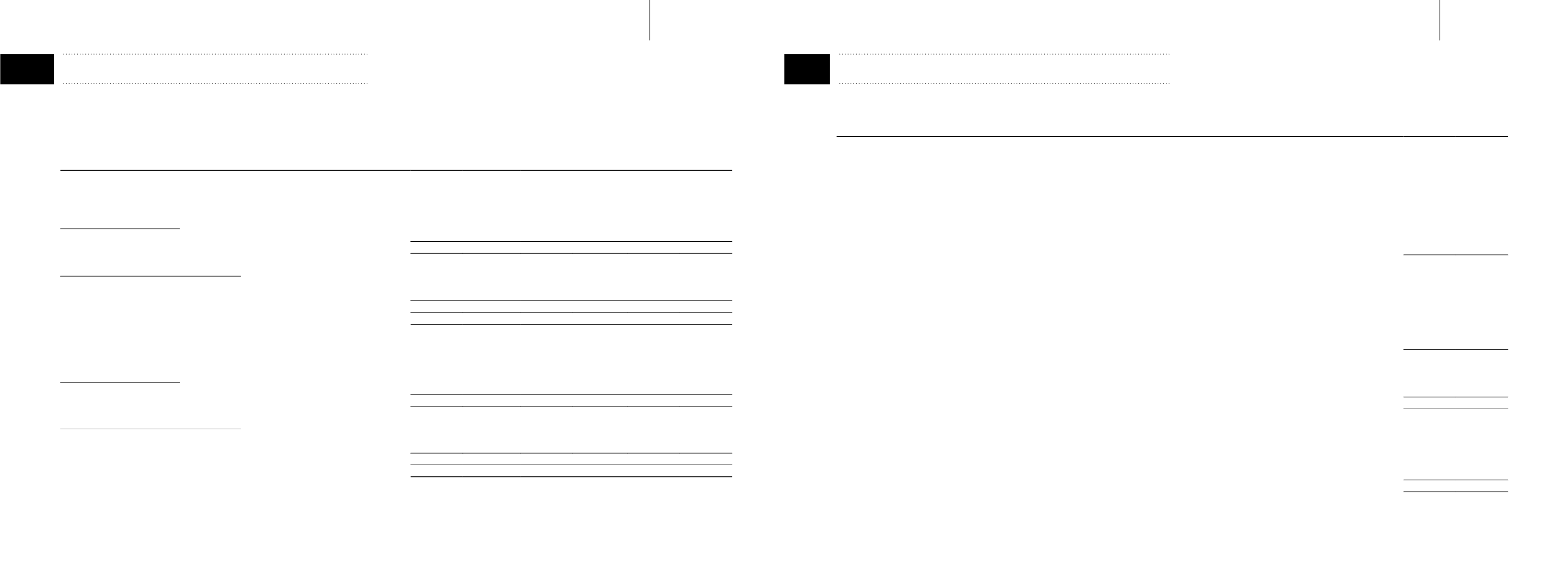

Attributable toownersof theCompany

Company

Share

capital

(Note21)

Capital

reserve

(1)

Retained

earnings

Fairvalue

reserve

Total

reserves

Total

equity

$’000

$’000

$’000

$’000

$’000

$’000

2015

At 1January2015

95,547

2,344

78,319

91 80,754 176,301

Profit for the year

–

–

12,630

– 12,630 12,630

Other comprehensive income

Net losson fair value changesof available-for-sale financial assets

–

–

–

(318)

(318)

(318)

Total comprehensive income for the year

–

–

12,630

(318)

12,312 12,312

Contributionsby anddistributions toowners

Issuanceof newordinary shares from conversionofwarrants

13,241

–

–

–

– 13,241

Dividendsonordinary shares (Note28)

–

–

(10,075)

– (10,075)

(10,075)

Total contributionsby anddistribution toowners

13,241

–

(10,075)

– (10,075)

3,166

At 31December2015

108,788

2,344

80,874

(227)

82,991 191,779

2014

At 1January2014

86,851

2,344

99,597

– 101,941 188,792

Profit for the year

–

–

23,968

–

23,968

23,968

Other comprehensive income

Net gainon fair value changesof available-for-sale financial assets

–

–

–

91

91

91

Total comprehensive income for the year

–

–

23,968

91

24,059

24,059

Contributionsby anddistributions toowners

Issuanceof newordinary shares from conversionofwarrants

8,696

–

–

–

–

8,696

Dividendsonordinary shares (Note28)

–

–

(45,246)

– (45,246)

(45,246)

Total contributionsby anddistribution toowners

8,696

–

(45,246)

– (45,246)

(36,550)

At 31December2014

95,547

2,344

78,319

91

80,754 176,301

(1)

Capital reservearose from restructuringexercise inprior years.

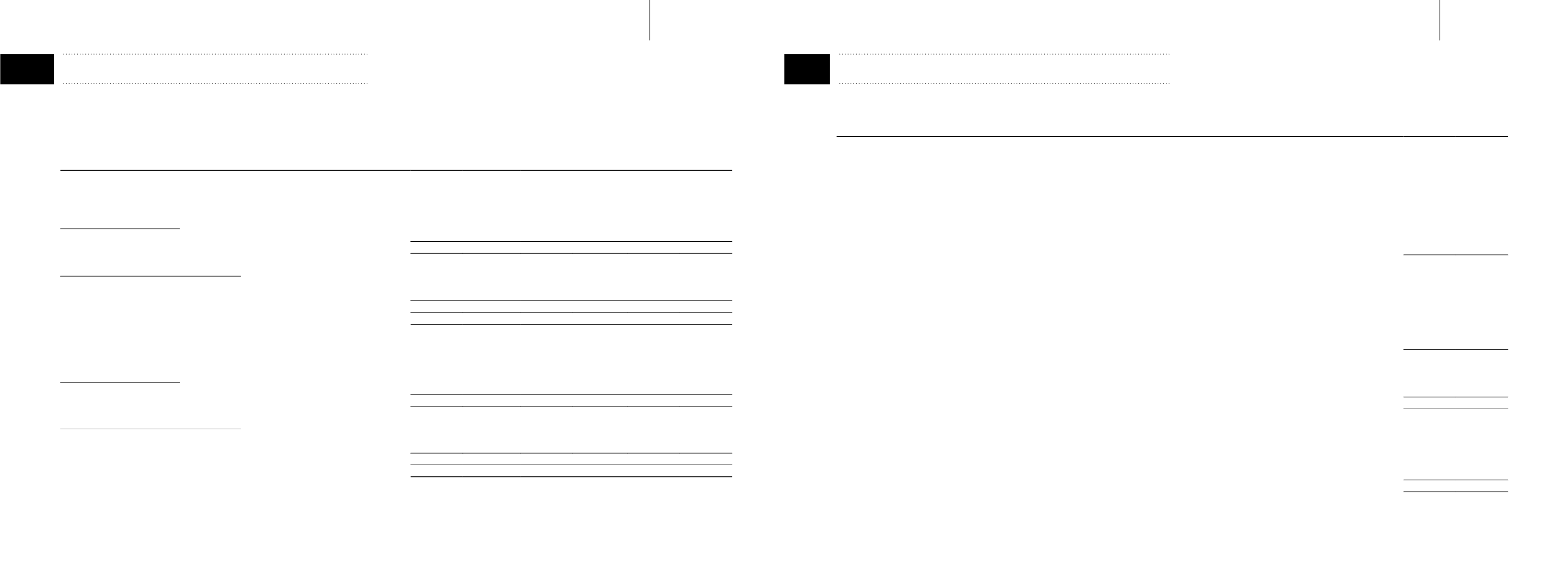

2015

2014

$’000

$’000

Cash flows fromoperatingactivities

Profit before tax

11,124

16,326

Adjustments for:

Depreciationof property, plant andequipment

1,811

2,211

Inventorieswrittendown

625

1,950

Provision for doubtful debt

35

–

Interest income

(1,092)

(896)

(Write-back)/provision forwarranty

(2,452)

189

Unrealised foreignexchangegain

(4,001)

(2,544)

Operatingcash flowsbeforeworkingcapital changes

6,050

17,236

Increase in inventoriesandwork-in-progress

(37,860)

(7,863)

Decrease/(increase) ingrossamount due from customers for contractwork-in-progress

13,004

(5,162)

(Decrease)/increase ingrossamount due to customers for contractwork-in-progress

(1,049)

1,809

(Increase)/decrease in tradeandother receivables

(3,733)

5,773

Increase inprepaidoperatingexpenses

(38)

(65)

Increase/(decrease) in tradeandother payables

2,875

(137)

Cash flows (used in)/fromoperations

(20,751)

11,591

Interest received

975

785

Income taxpaid

(2,713)

(3,346)

Net cash flows (used in)/fromoperatingactivities

(22,489)

9,030

Cash flows from investingactivities

Purchaseof property, plant andequipment

(11,554)

(5,551)

Purchaseof intangibleasset

(227)

(834)

Maturity of short-termdeposits

–

4,000

Purchaseof investment securities

(1,183)

(5,740)

Net cash flowsused in investingactivities

(12,964)

(8,125)

Statementsofchanges inequity

For the financial year ended31December 2015

Consolidatedcashflowstatement

For the financial year ended31December 2015

Theaccompanyingaccountingpoliciesandexplanatorynotes forman integral part of the financial statements.

Theaccompanyingaccountingpoliciesandexplanatorynotes forman integral part of the financial statements.

74

75

BAKERTECHNOLOGYlimited

ANNUAL REPORT 2015