57

ANNUAL REPORT 2015

CORPORATEGOVERNANCEREPORT

56

BAKERTECHNOLOGYlimited

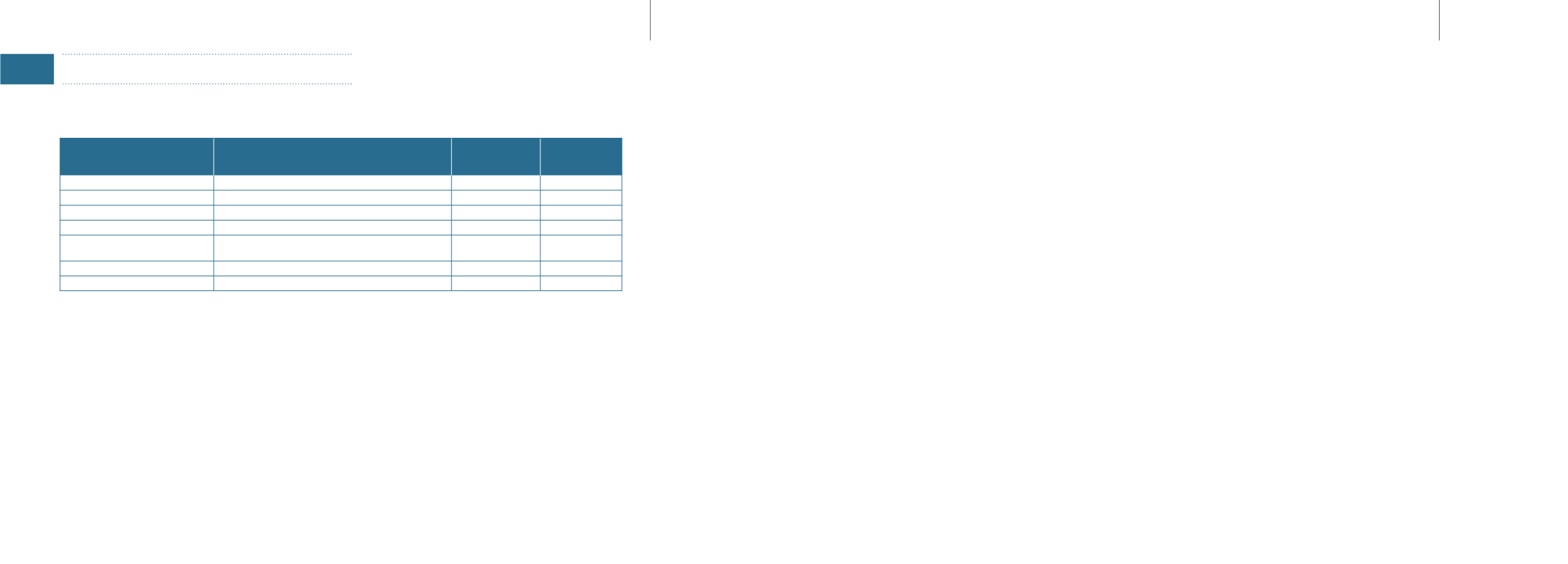

The tablebelow shows the remunerationof the topfivekeymanagement personnel (whoarenotDirectorsor theCEO) (“KMP”) forFY2015:

TopfiveKMP

Designation

Salary, CPF&

Allowance

(%)

Bonus

(%)

$1,100,000 to$1,200,000

OngThianWheeAlbert

ManagingDirector (SeaDeepShipyardPte. Ltd.)

21

79

$300,000 to$400,000

TanKiangKherng

Chief Financial Officer (Baker TechnologyLimited)

82

18

TanKengTiongAlvin

Senior VicePresident -BusinessDevelopment

(Baker TechnologyLimited)

83

17

TanWeeLee

ManagingDirector (BakerEngineeringPte. Ltd.)

78

22

HeathMcIntyre

ManagingDirector (BT Investment Pte. Ltd.)

90

10

The total remunerationpaid to the topfiveKMPs forFY2015amounted to$2,573,584.

The Company believes that it may not be in the Group’s interest to disclose the remuneration of the KMP to the level as recommended by the Code, given highly

competitivehiring conditionsand theneed to retain theGroup’s talent pool.

EmployeeRelated toDirectors/CEO

Saveasdisclosed in theaboveremuneration table forDirectors, there isnoemployee in theGroupwhoare immediate familymembersofanyof thedirectorsor theCEO

andwhoseremunerationexceeded$50,000duringFY2015. “Immediate familymember”meansspouse, child,adoptedchild,step-child,brother,sisterandparent.

ACCOUNTABILITYANDAUDIT

Principle10:Accountability

The Board, through its announcements of quarterly and full-year results as well as price sensitive issues, aims to provide shareholders with a balanced and

understandableassessment of theGroup’sfinancial performance, positionandprospects.

The Company recognises the importance of providing the Board with a continual flow of relevant information on an accurate and timely basis in order that it may

effectively discharge its duties. On a regular basis, Boardmembers are provided with business and financial reports comparing actual performance with budget,

highlightsonkey business indicatorsandothermajor issues.

For the financial year under review, the CEO and the CFO have provided assurance to theBoard on the integrity of the financial statements for the Company and its

subsidiaries.

Principle11:RiskManagement and InternalControls

TheBoardhasoverall responsibility for themanagement of theGroup’skey risks to safeguard shareholders’ interestsand itsassets.

The Audit Committee (“AC”) assists the Board in providing riskmanagement oversight while the ownership of day-to-day management andmonitoring of existing

internal control systemsaredelegated toManagementwhich comprise theExecutiveDirectorsand senior executivesof theGroup.

TheAC,with theassistanceof the internal auditors, reviews theadequacyandeffectivenessof theCompany’s internal control systems, includingfinancial, operational,

compliance and information technology controls and risksmanagement policies and systems established by theManagement on an annual basis. In addition, the

external auditors will highlight any material control weaknesses within the Group discovered in the course of the statutory audit. Any material findings from both

the internal and external auditors together with the improvement recommendations are reported to the AC. The ACwill review the internal and external auditors’

commentsandfindings, ensure that thereareadequate internal controlswithin theGroupand followuponactions implemented.

As theenvironment inwhich theGroupoperateschanges, risksandopportunitieschange.Under theenterprise-wideriskmanagement framework (“ERMFramework”)

establishedby theCompany,Management at all levelsareexpected toconstantly review thebusinessoperationsand theenvironment that theGroupoperates inorder

to identifyareasandensuremitigatingmeasuresarepromptlydeveloped toaddress these risks.Aspartof the framework, risk registerswereestablished todocument

the key risks, risk appetite, risk tolerance, risk evaluation andmitigating controls. Management will regularly review the key risks, both existing and emerging new

risks; determine thekeyowners for the risks identified; ensuring treatmentmeasures formitigating these risksarepromptlyandproperly implemented; andensuring

policies and controls are compliedwith.Management reports to theAC on a quarterly basis.Mitigating actions and additional countermeasures inmanaging the key

risks, aswell asactionplans toaddress thegapsare consideredanddocumented.

For 2015, theBoard and the AC had in addition received assurance from the CEO and the CFO that theGroup’s financial records have been properlymaintained and

thefinancial statements give a true and fair viewof theGroup’s operations andfinances; andon the adequacy andeffectiveness of theGroup’s riskmanagement and

internal control systems.

Basedon theERMFrameworkestablished,reviewscarriedoutby theAC, theworkperformedby the internalandexternalauditorsandassurance from theManagement,

theBoard, with the concurrence of theAC, is of the opinion that the internal controls and riskmanagement systemsmaintainedbyManagement during thefinancial

year andup to thedateof this report areadequate inaddressingfinancial, operational, complianceand information technology risksand tomeet the current scopeof

theGroup’s business operations. TheAC and theBoardnote that no system of internal controls is capable of providing absolute assurance against the occurrence of

material errors, poor judgment indecision-making, humanerror, losses, fraudor other irregularities.