. 10 9

ANNUAL

REPORT

20 1 7

THE BE ST

I N US

NOTESTOTHE

FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2017

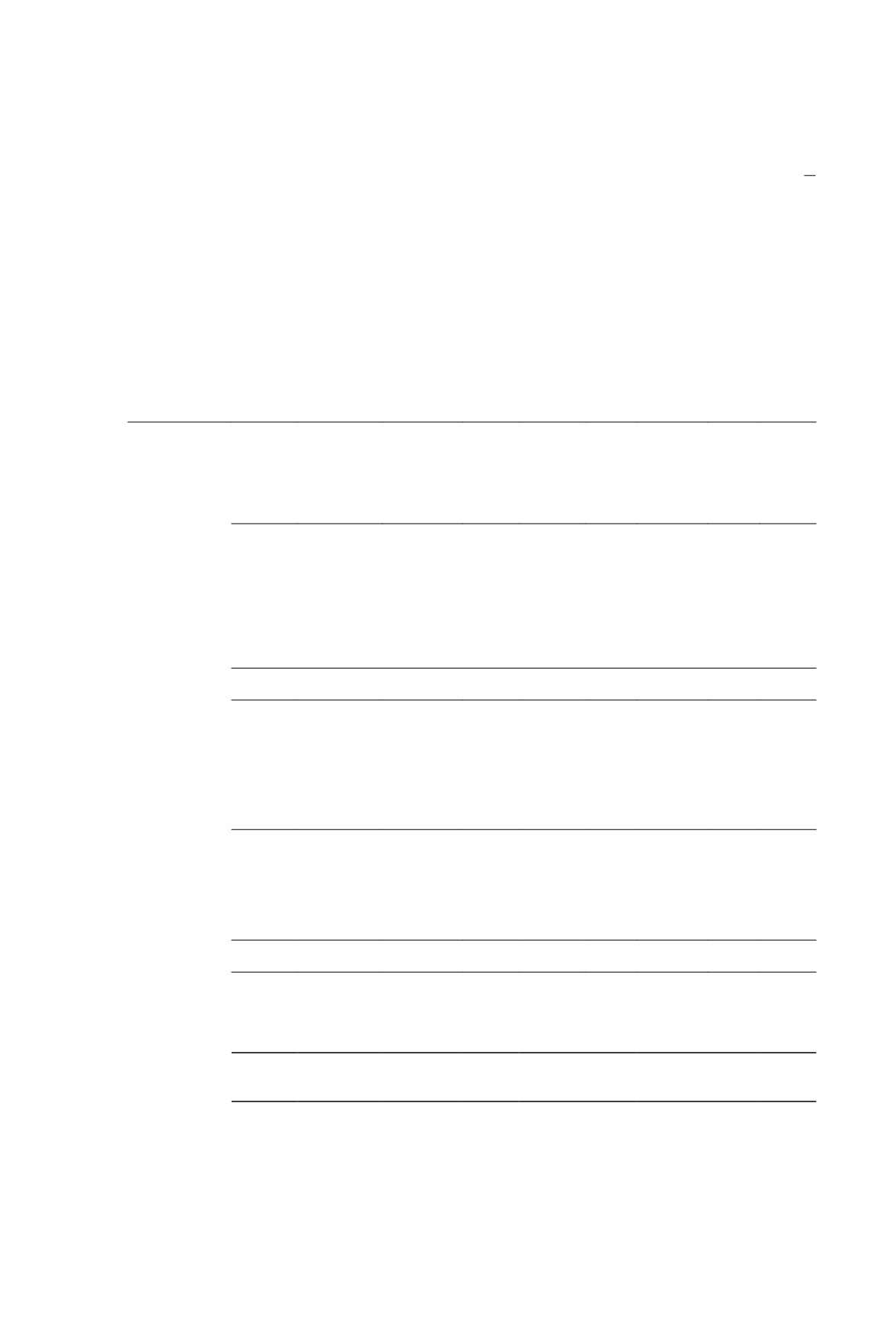

10.

PROPERTY, PLANTANDEQUIPMENT

Group

Leasehold

landsand

buildings

Leasehold

improvements

Assets

under

construction

Furniture

and

fittings

Office

equipment

Motor

vehicles

Plant and

equipment

Vessel

Total

$’000

$’000

$’000 $’000

$’000 $’000

$’000 $’000 $’000

Cost:

At 1 January 2016 16,740

6,641

217

371 1,171 421 11,830

– 37,391

Additions

–

148

1,556

12

59

–

223

– 1,998

Disposal/write-off

–

–

–

–

(7)

–

(1)

– (8)

Reclassification

–

1,225

(1,226)

–

– –

1

–

–

At 31December

2016 and

1 January 2017 16,740

8,014

547

383 1,223 421 12,053

– 39,381

Additions

–

80

24

–

534

–

51

– 689

Transfer from

work-in-

progress

–

–

–

–

– –

– 100,050 100,050

Reclassification

–

560

(571)

–

11

–

–

–

–

At 31December

2017

16,740

8,654

– 383 1,768 421 12,104 100,050 140,120

Accumulated

depreciation:

At 1 January 2016 7,749

3,904

– 145

664 185 6,668

– 19,315

Depreciation

charge for

the year

939

746

– 69

287

69 1,502

– 3,612

Disposal/write-off

–

–

–

–

(7)

–

–

– (7)

At 31December

2016 and

1 January 2017 8,688

4,650

– 214

944 254 8,170

– 22,920

Depreciation

charge for

the year

932

1,056

– 71

250

61 1,420

– 3,790

At 31December

2017

9,620

5,706

– 285 1,194 315 9,590

– 26,710

Net carrying

amount:

At 31December

2016

8,052

3,364

547

169

279 167 3,883

– 16,461

At 31December

2017

7,120

2,948

– 98

574 106 2,514 100,050 113,410