. 114

NOTESTOTHE

FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2017

BAKER

TECHNOLOGY

L IMI TED

THE BE ST

I N US

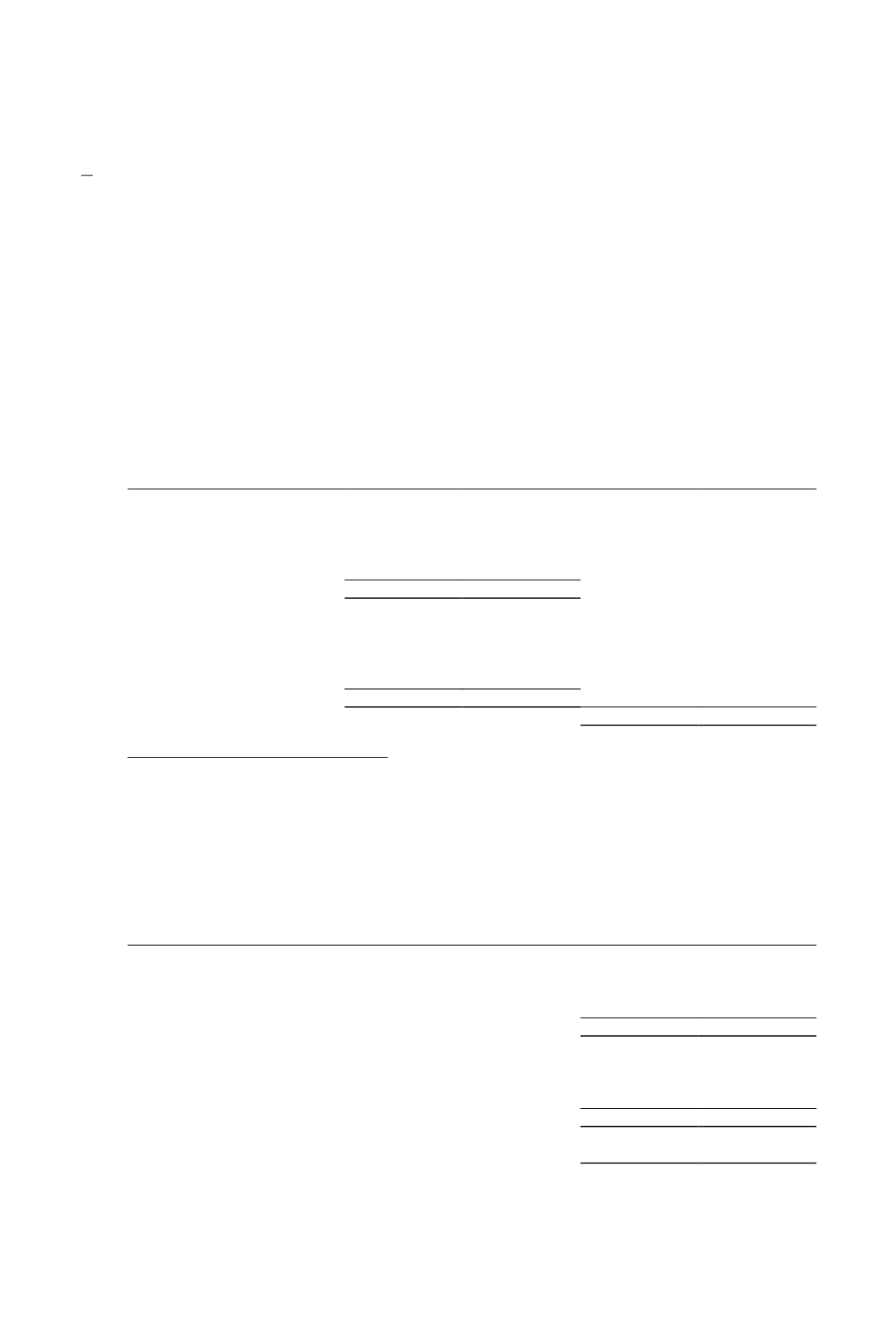

14.

DEFERREDTAX

Deferred tax as at 31December relates to the following:

Group

Consolidated

balance sheet

Consolidated statement

of comprehensive income

2017

2016

2017

2016

$’000

$’000

$’000

$’000

Deferred tax assets:

Provisions

20

252

232

118

Differences indepreciation

for taxpurposes

(3)

(4)

(1)

(6)

17

248

Deferred tax liabilities:

Provisions

45

75

30

(34)

Differences indepreciation

for taxpurposes

(89)

(530)

(441)

339

(44)

(455)

Deferred tax expense

(180)

417

Tax consequenceof proposeddividends

There are no income tax consequences attached to the dividends proposed by the Company to the

shareholders but not recognised as a liability in the financial statements (Note28).

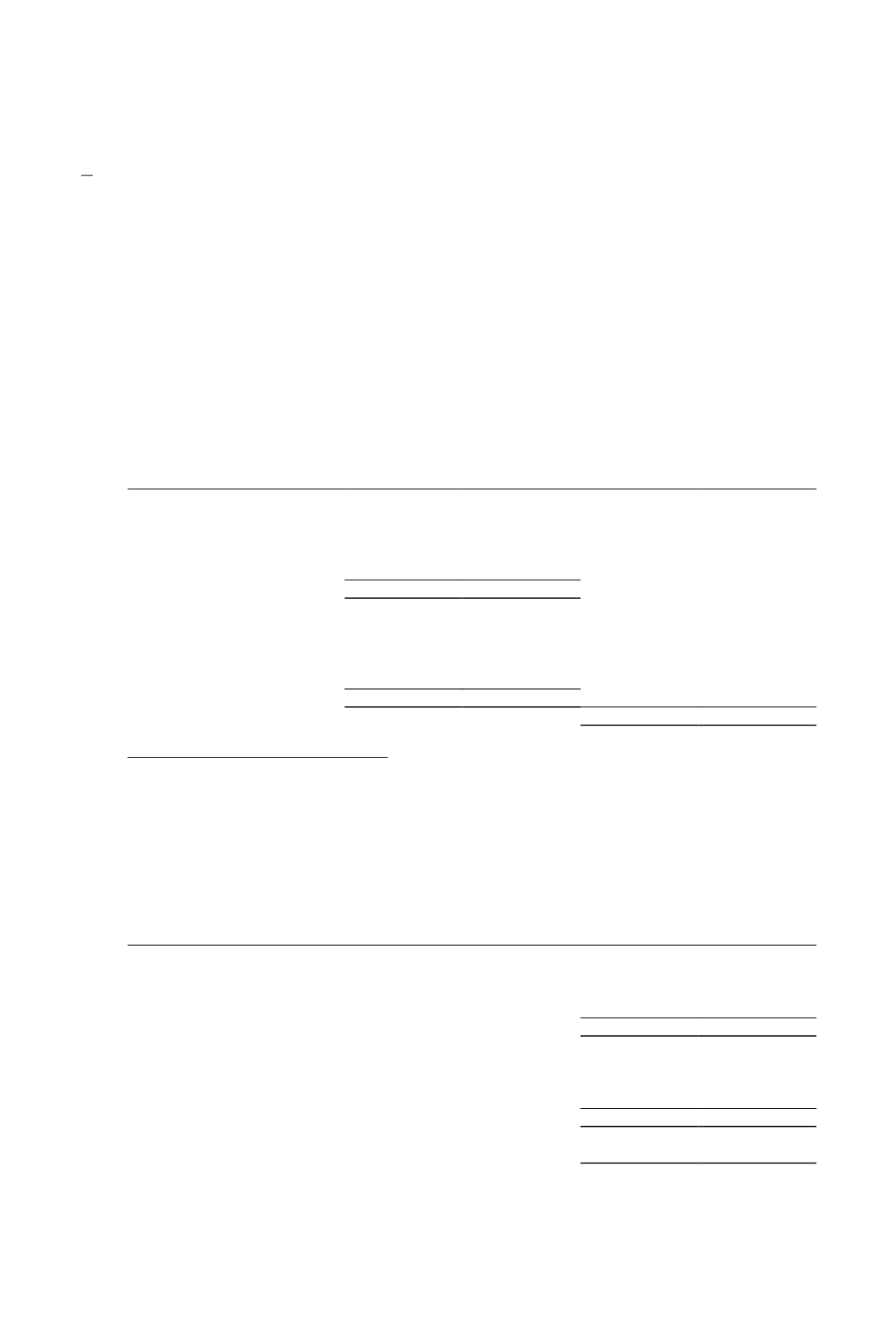

15.

GROSSAMOUNTDUE FROM / (TO) CUSTOMERS FORCONTRACTWORK-IN-PROGRESS

Group

2017

2016

$’000

$’000

Aggregate amount of costs incurred and recognisedprofits

(less recognised losses) todate

3,272

3,155

Less: Progress billings and advances

(3,315)

(2,238)

(43)

917

Presented as:

Gross amount due fromcustomers for contractwork-in-progress

61

1,039

Gross amount due tocustomers for contractwork-in-progress

(104)

(122)

(43)

917

Retention sumsonconstructioncontract included in trade receivables

–

1,391