. 117

ANNUAL

REPORT

20 1 7

THE BE ST

I N US

NOTESTOTHE

FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2017

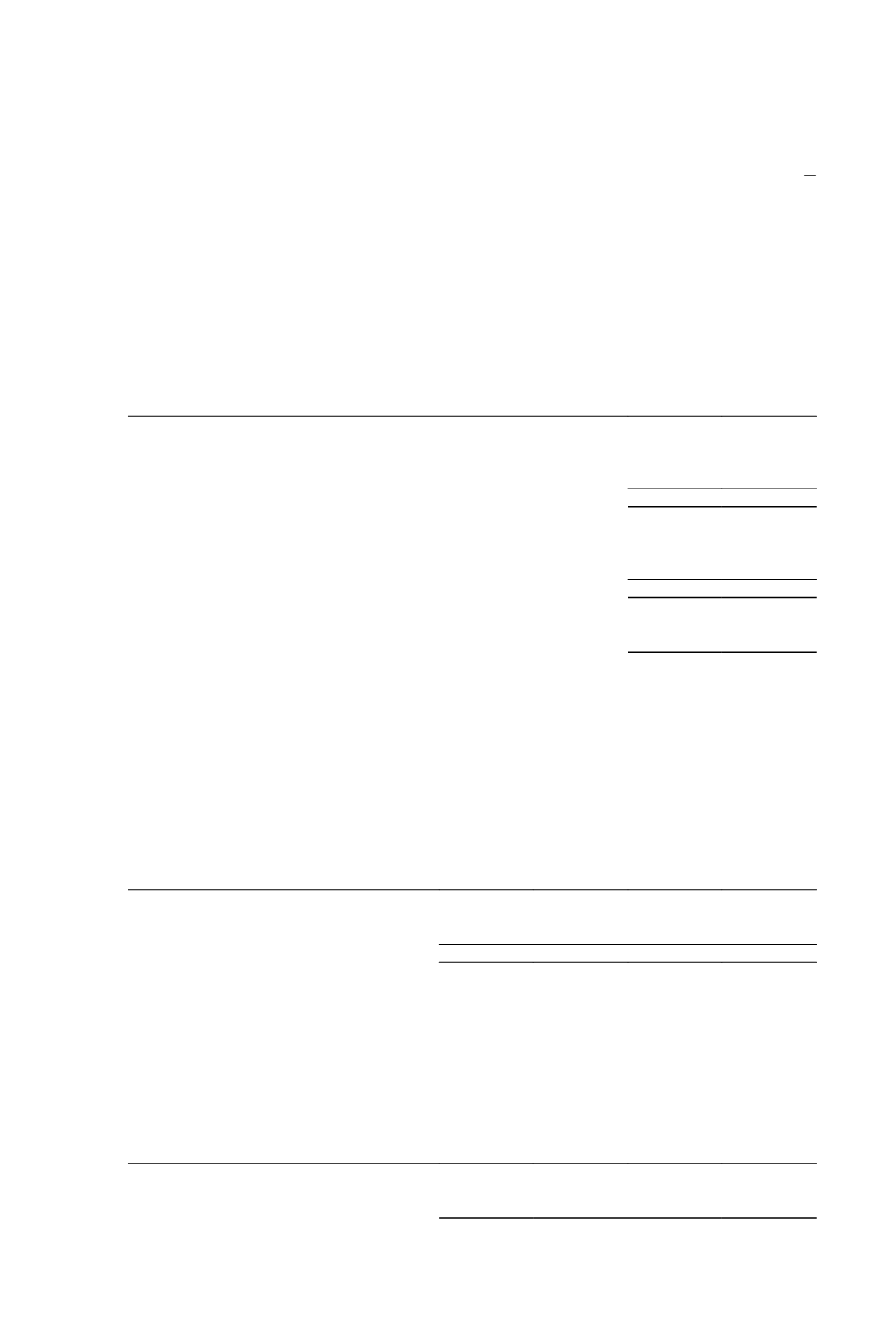

18.

AMOUNTSDUE FROM/(TO) SUBSIDIARIES

Company

2017

2016

$’000

$’000

Amount due from:

Non-trade receivables–nominal amounts

122,141

107,074

Less: Allowance for impairment

(21,500)

(14,000)

100,641

93,074

Movement in allowance account:

At 1 January

14,000

–

Charge for the year

7,500

14,000

At 31December

21,500

14,000

Amount due to:

Non-tradepayables

5,000

5,653

The amounts due from/(to) subsidiaries areunsecured, non-interest bearing and are repayableondemand.

In the current financial year, an impairment loss of $7,500,000 (2016: $14,000,000) was recognised in

the Company’s profit or loss subsequent to an assessment of the carrying amount of the amounts due

from subsidiaries.

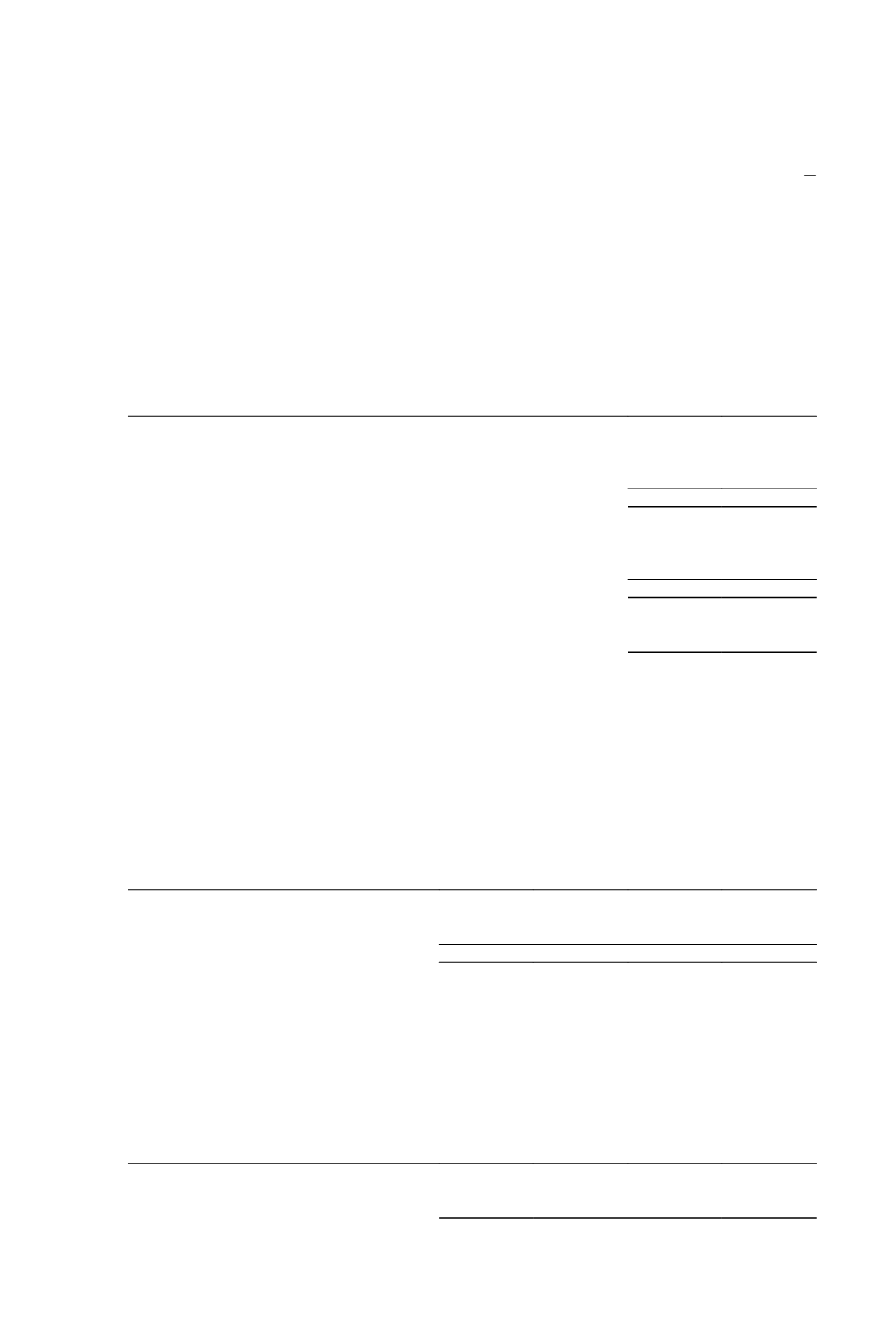

19.

CASHANDSHORT-TERMDEPOSITS

Group

Company

2017

2016

2017

2016

$’000

$’000

$’000

$’000

Cash at banks andonhand

28,984

38,205

22,214

30,406

Short-termdeposits

57,658

68,751

57,658

68,751

86,642

106,956

79,872

99,157

Cashatbanksearns interestat floating ratesbasedondailybankdeposit rates. Short-termdepositsaremade

for varyingperiods of betweenoneweek to threemonths dependingon the immediate cash requirements

of theGroupandCompany, andearn interestsat the respectiveshort-termdeposit rates ranging from0.10%

to1.20% (2016: 0.25% to1.10%) per annum.

Cash and short-termdeposits denominated in foreigncurrencies at 31December are as follows:

Group

Company

2017

2016

2017

2016

$’000

$’000

$’000

$’000

United StatesDollar

43,960

39,758

38,659

35,448

Euro

397

480

18

20