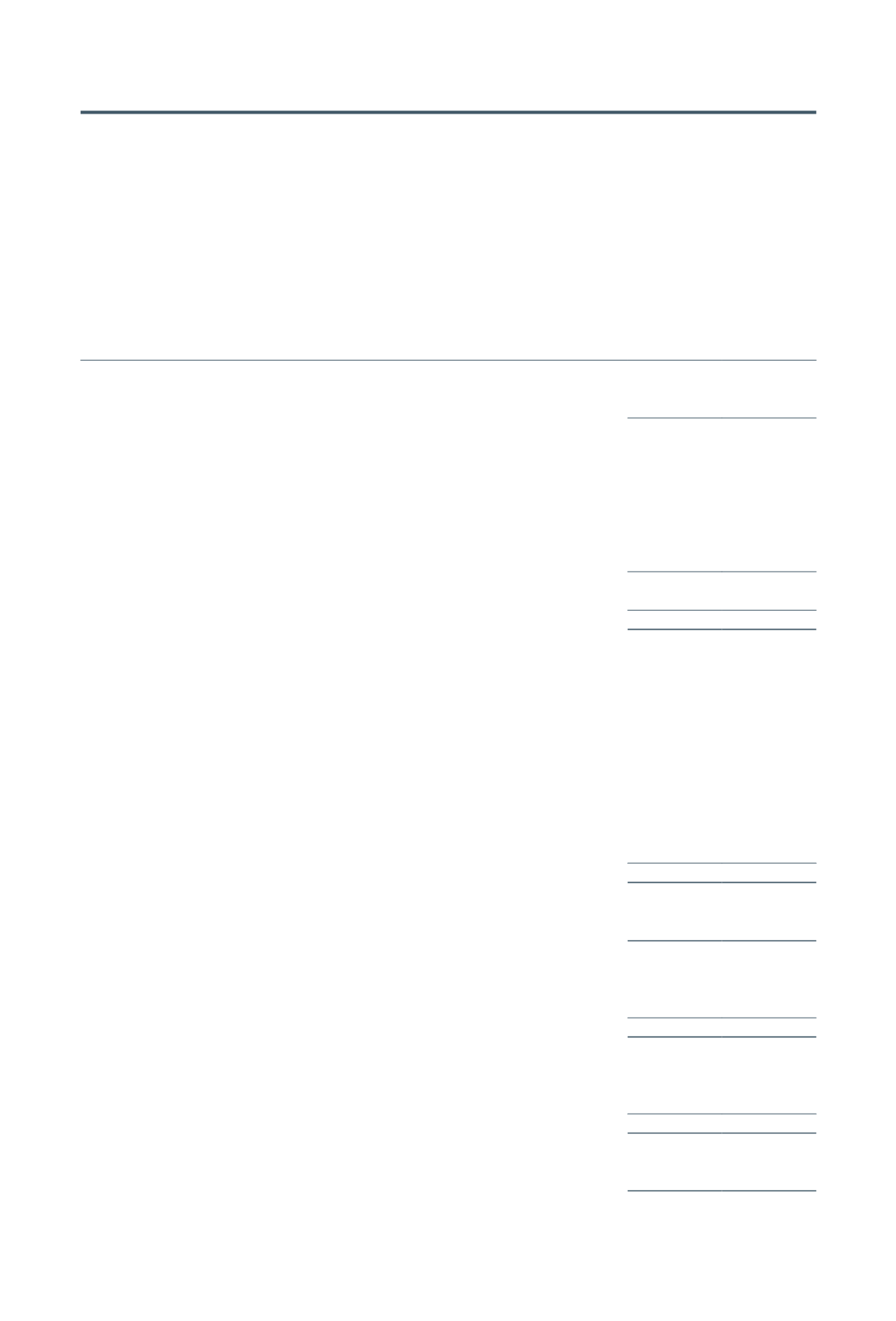

68

B A K E R T E C H N O L O G Y

L I M I T E D

Group

Note

2018

2017

$’000 $’000

Revenue

5

32,702

5,002

Cost of sales

(23,326)

(2,383)

Gross profit

9,376

2,619

Other income

6

25,648

735

Other items of expenses

Administrative expenses

(17,264)

(10,598)

Finance cost

(206)

–

Other expenses

6

–

(4,039)

Share of results of associates

(3,101)

–

Profit/(loss) before tax

7

14,453 (11,283)

Income tax (expense)/credit

8

(138)

593

Profit/(loss) for the year

14,315 (10,690)

Other comprehensive income, net of tax

Items that will not be reclassified subsequently to

profit or loss

Net fair value gains on equity instruments at fair value

through other comprehensive income

40

–

Items that may be reclassified subsequently to

profit or loss

Net fair value losses on debt instruments at fair value

through other comprehensive income

(15)

–

Net fair value changes on available-for-sale financial assets

–

73

Foreign currency translation

(345)

–

(320)

73

Total comprehensive income for the year attributable to

owners of the Company

13,995 (10,617)

Profit/(loss) for the year attributable to:

Owners of the Company

17,624 (10,690)

Non-controlling interests

(3,309)

–

14,315 (10,690)

Total comprehensive income for the year attributable to:

Owners of the Company

17,581

(10,617)

Non-controlling interests

(3,586)

–

Total comprehensive income

13,995 (10,617)

Earnings per share attributable to Owners of the Company

Basic and diluted (in cents)

9

8.7

(5.3)

Consolidated statement of

comprehensive income

For the financial year ended 31 December 2018

The accompanying accounting policies and explanatory notes form an integral part of the financial statements.