Notes to the

financial statements

For the financial year ended 31 December 2018

102

B A K E R T E C H N O L O G Y

L I M I T E D

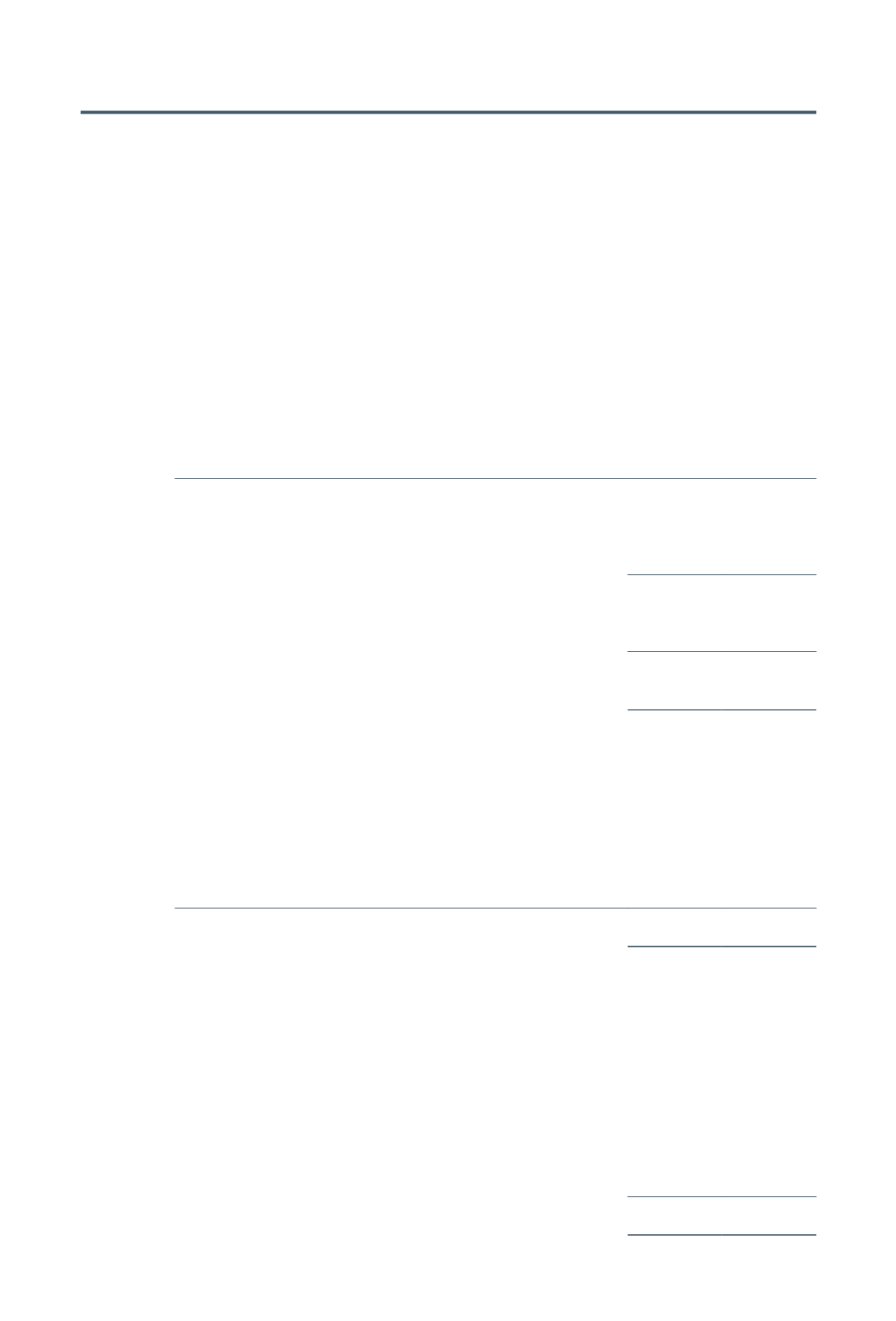

8.

Income tax expense/(credit)

(a)

Major components of income tax expense/(credit)

The major components of income tax expense/(credit) for the years ended 31 December are:

Group

2018

2017

$’000

$’000

Statement of comprehensive income:

Current income tax:

– Current income taxation

7

–

– Over provision in respect of prior years

–

(413)

7

(413)

Deferred income tax:

– Origination and reversal of temporary difference (Note 16)

131

(180)

Income tax credit recognised in the

statement of comprehensive income

138

(593)

(b)

Relationship between tax expense/(credit) and accounting profit/(loss)

A reconciliation between tax expense/(credit) and the product of accounting profit/(loss)

multiplied by the applicable corporate tax rate for the years ended 31 December are as

follows:

Group

2018

2017

$’000

$’000

Profit / (loss) before tax

14,453

(11,283)

Income tax credit at the applicable tax rate of

17% (2017:17%)

2,457

(1,918)

Adjustments for tax effect of:

Deferred tax assets not recognised

1,485

1,907

Deferred tax benefits utilised

(129)

–

Income not subject to taxation

(4,201)

–

Tax incentive

(4)

(1,185)

Net marine offshore income not subject to tax

(1)

(1,364)

–

Non-deductible expenses

1,337

941

Tax effect of share of results of associates

527

–

Over provision in respect of prior years

–

(413)

Others, net

30

75

Income tax expense / (credit) recognised in profit or

loss

138

(593)

(1)

This represents net income exempted under Section 13A and tax exemption under Section 43(6) of the

Singapore Income Tax Act