Notes to the

financial statements

For the financial year ended 31 December 2018

97

A N N U A L R E P O R T

2 0 1 8

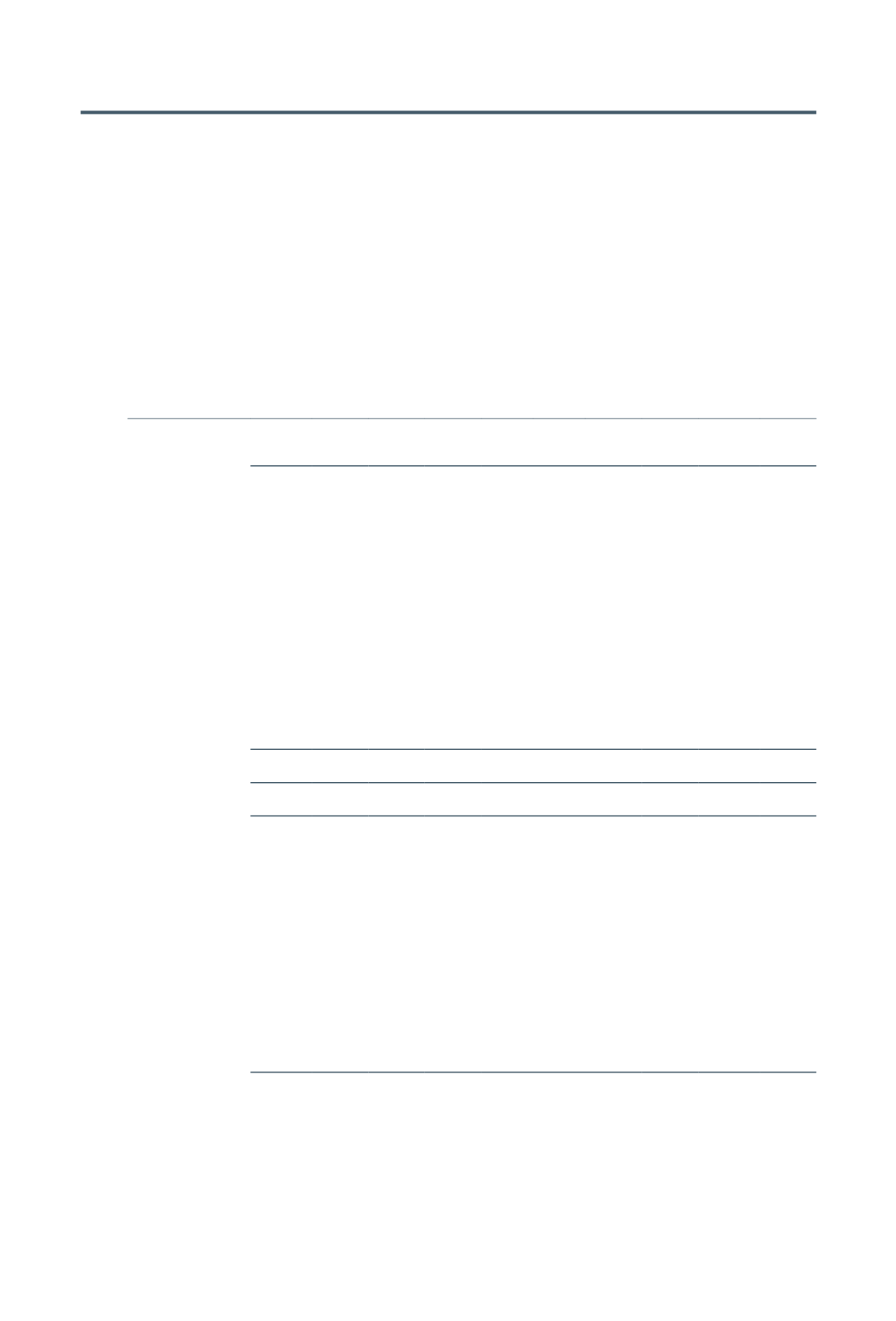

4.

Segment information (cont’d)

Marine offshore Investments

Corporate

Adjustments

and

elimination

Per consolidated

financial

statements

2018 2017 2018 2017 2018 2017 2018 2017 2018 2017

$’000 $’000 $’000 $’000 $’000 $’000 $’000 $’000 $’000 $’000

Revenue – external

customers

32,702

5,002

–

–

–

–

–

–

32,702

5,002

Results:

Depreciation and

amortisation

(11,620)

(2,825)

–

–

(2)

(3)

–

–

(11,622)

(2,828)

Interest income

162

12

24

187

336

462

–

–

522

661

Interest expense

(206)

–

–

–

–

–

–

–

(206)

–

Inventories and work-

in-progress written

down

(32)

(501)

–

–

–

–

–

–

(32)

(501)

Contract assets

written down

(506)

–

–

–

–

–

–

–

(506)

–

Write back for

warranty

341

1,176

–

–

–

–

–

–

341

1,176

Bargain purchase gain

–

–

24,709

–

–

–

–

–

24,709

–

Share of results of

associates

(3,101)

–

–

–

–

–

–

–

(3,101)

–

Segment profit/(loss)

(7,891)

(5,338)

31,083

(200)

3,741

(4,546)

(12,480)

(1,199)

14,453

(11,283)

Segment assets

285,904

128,736

51,142

195

14,646

79,942

(47,113)

–

304,579

208,873

Segment liabilities

27,806

5,918

63

29

601

412

–

–

28,470

6,359

Other segment

information:

Purchase of

investment

securities

–

–

120

302

–

–

–

–

120

302

Additions to non-

current assets:-

– Investment in

associates

4,979

–

–

–

–

–

–

–

4,979

–

– Purchase of

property,

plant and

equipment

8,822

682

–

–

–

7

–

–

8,822

689

– Transfer from

work-in-

progress

–

100,050

–

–

–

–

–

–

–

100,050