financial

review

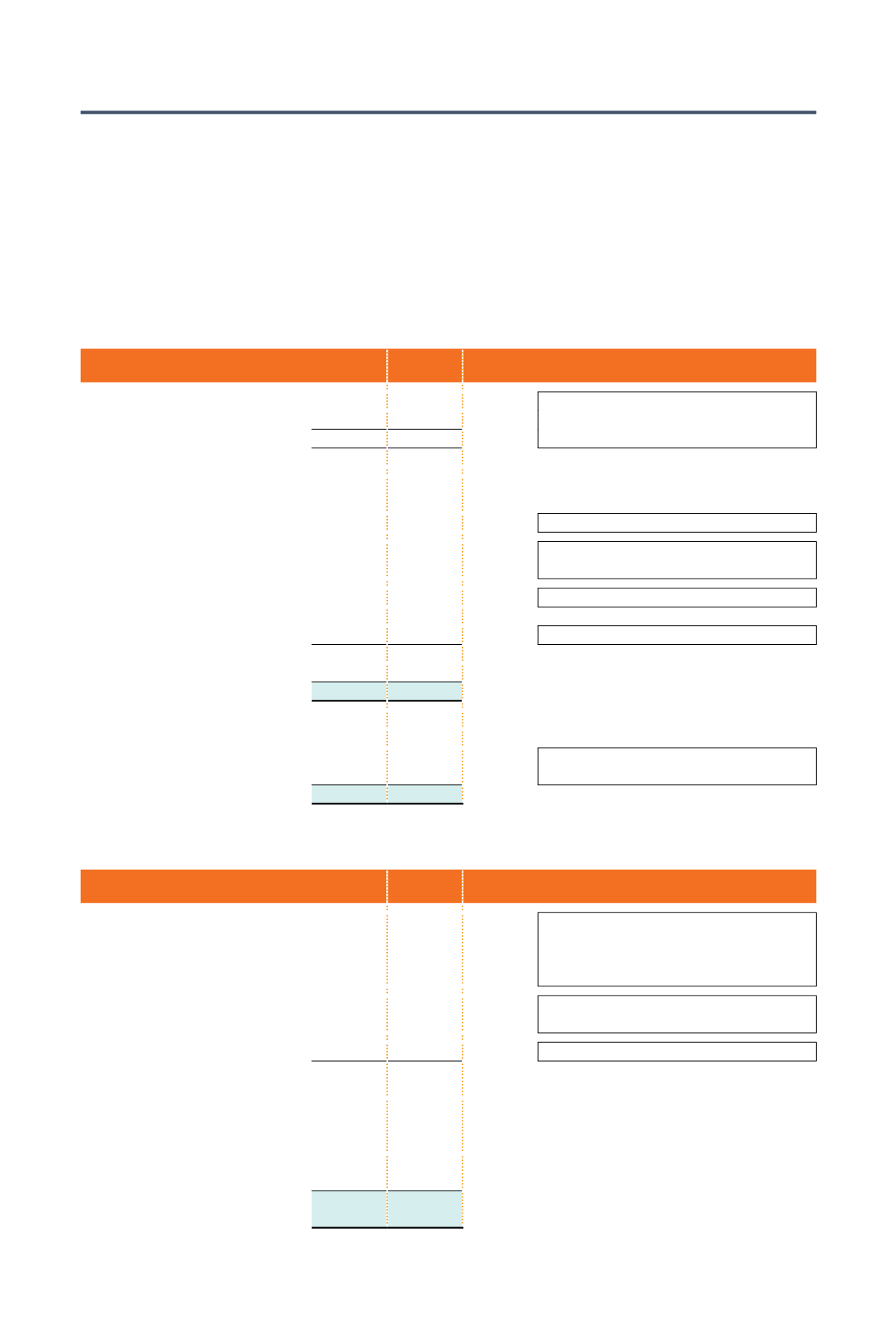

Income Statement

2018

$’000

2017

$’000

Changes

%

Explanatory Notes

Revenue

32,702 5,002

NM Increase in revenue contributed by

fabrication projects and services,

charter income and acquisition of CHO

Cost of goods sold

(23,326)

(2,383)

NM

Gross profits

9,376 2,619

NM

Gross profit margin

29% 52%

NM

Other operating income /

(expenses), net

619

735 -16%

Bargain purchase gain

24,709

- NM Acquisition of CHO

Foreign exchange gain / (loss)

320 (4,039)

NM Gain due to strengthening of USD

against SGD during the year

Administrative expenses

(17,264) (10,598)

+63% In line with increase in revenue

Finance cost

(206)

- NM

Share of results of associates

(3,101)

- NM Acquisition of CHO

Profit / (loss) before tax

14,453 (11,283)

NM

Income tax (expenses) / credit

(138)

593 NM

Profit / (loss) after tax

14,315 (10,690)

NM

Attributable to:

Owners of the Company

17,624 (10,690)

NM

Non-controlling interest

(3,309)

- NM Losses attributed to the 45.02%

minority shareholders of CHO

Profit / (loss) after tax

14,315 (10,690)

NM

Cash Flows

2018

$’000

2017

$’000

Changes

%

Explanatory Notes

Cash used in operating

activities

(9,330)

(16,363)

-43% Shortfall in operating cash flows

funded from internal cash resources

(including warrant proceeds from

rights issue in FY2012)

Cash (used in) / from investing

activities

(49,244)

1,986 NM

Paid $47.1 million for 54.98% in CHO

Cash used in financing activities

- (2,536)

-100% No dividend payment during FY2018

Net decrease in cash & cash

equivalents

(58,574)

(16,913)

246%

Effect of exchange rate

changes on cash and cash

equivalents

852 (3,401)

NM

Cash & cash equivalents at

beginning of year

86,642 106,956 -19%

Cash & cash equivalents

at end of year

28,920 86,642 -67%

* NM denotes Not Meaningful

11

A N N U A L R E P O R T

2 0 1 8