W

hile theGroup’s revenue

fell 77% in FY2017 at

$5.0million, gross profit

marginwas up at 52% in FY2017

from26% a year ago, supported

mainlybywrite-backof expired

warrantyprovisionduring the year.

Baker Tech recorded a foreign

exchange loss of $4.0million in

FY2017 as compared to a foreign

exchangegainof $1.2million

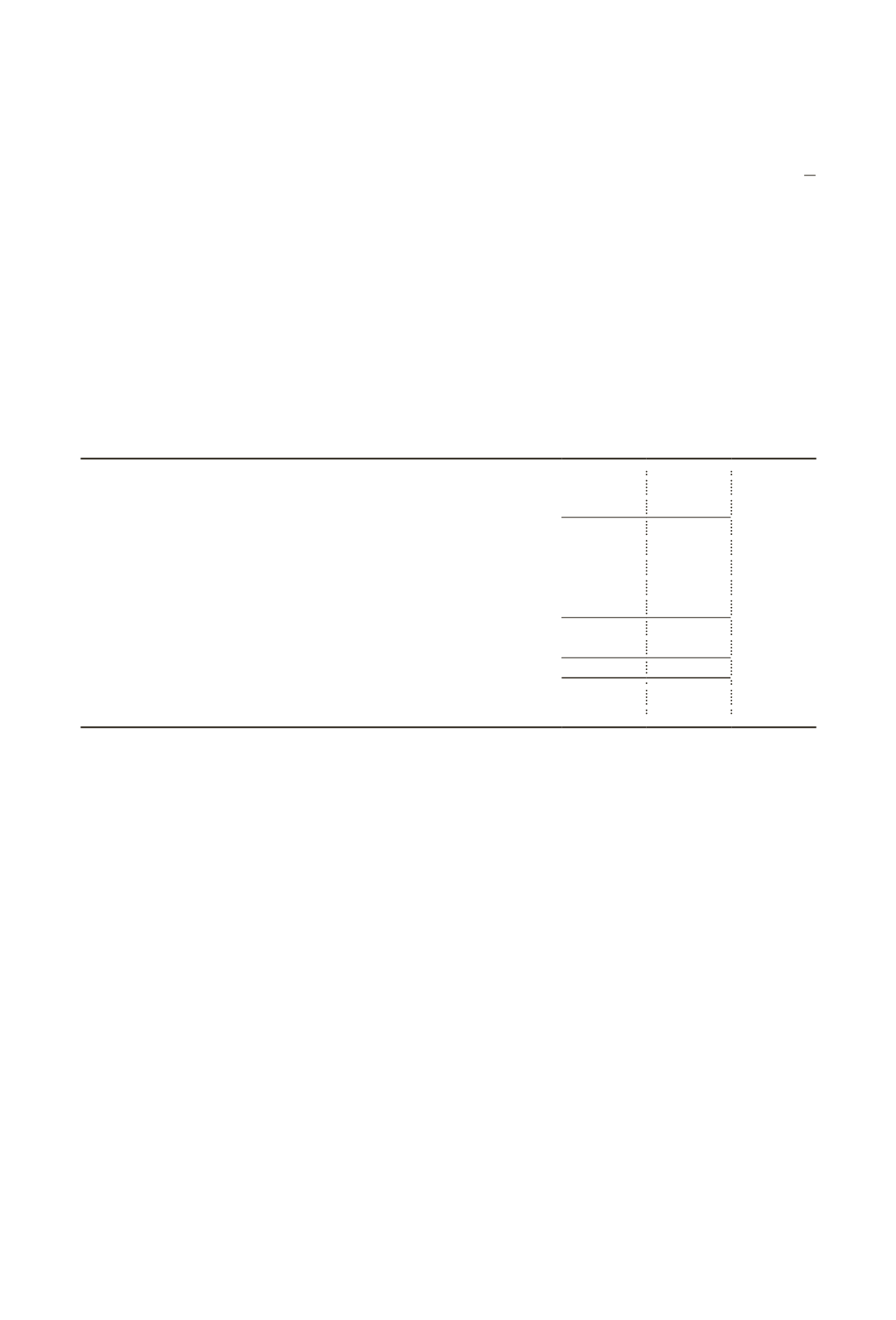

Financial

Review

2017

2016 Change

$’000

$’000

%

Revenue

5,002

21,520

-77%

Cost of goods sold

(2,383)

(15,849)

-85%

Grossprofit

2,619

5,671

-54%

Other operating income

713

2,425

-71%

Foreignexchange (loss) / gain

(4,039)

1,183

NM

Impairment of goodwill

–

(7,551)

-100%

Administrativeexpenses

(10,576)

(10,950)

-3%

Lossbefore tax

(11,283)

(9,222)

+22%

Income tax credit

593

895

-34%

Lossafter tax

(10,690)

(8,327)

+28%

Grossprofitmargin

52%

26%

* NM denotes Not Meaningful

IncomeStatement

in FY2016, dueprimarily to the

weakeningof theUSdollar against

the Singaporedollar.

DuringFY2016, theGroup recorded

an impairment loss of $7.6million

ongoodwill in a subsidiary in view

of theweakness of the industry.

Similarly, theGroup recognised

aone-offcompensation income

from a supplier for defective

materials in2Q2016. Theseevents

were absent in2017.

With thedecrease in revenue and

the foreignexchange losses,

Baker Tech reported apre-tax

loss of $11.3million in FY2017.

Net losswas at $10.7million after

a tax credit of $0.6millionprimarily

from thewrite-backof excess

taxprovision fromprior years.

. 27

ANNUAL

REPORT

20 1 7

THE BE ST

I N US