higher in2017due towrite-back

of expiredwarrantyprovision.

Although theUSdollar has

appreciated against Singapore

dollars by approximately 2.3% for

FY2016 anddepreciated against

Singaporedollars by approximately

8% for FY2017, thequarter-

to-quarter foreignexchange

movements hadbeen very volatile.

As a result, quarterlynet results

fluctuate significantly.

Q

uarterly revenuehas

generallybeen lower

throughout 2017as

compared to2016,

dampenedbyweakerdemand

stemmed fromuncertainties in the

global oil andgas industry.

As a result, theGroup reported

net losses for all quarters in2017.

For 2016, theGroup also reported

net loss for all quarterswith the

exceptionof 2Q2016where

theGroup recorded aone-off

compensation income from a

supplier for defectivematerials. Net

loss (excluding foreignexchange

gain / losses) increased to$7.6

million for 4Q2016mainlydue to

the recognitionof impairment loss

ongoodwill in a subsidiary.

Gross profitmargins varied

dependingon theproductmix

and stages of construction for the

projects beingundertakenduring

the various quarters. However,

overall gross profitmarginwas

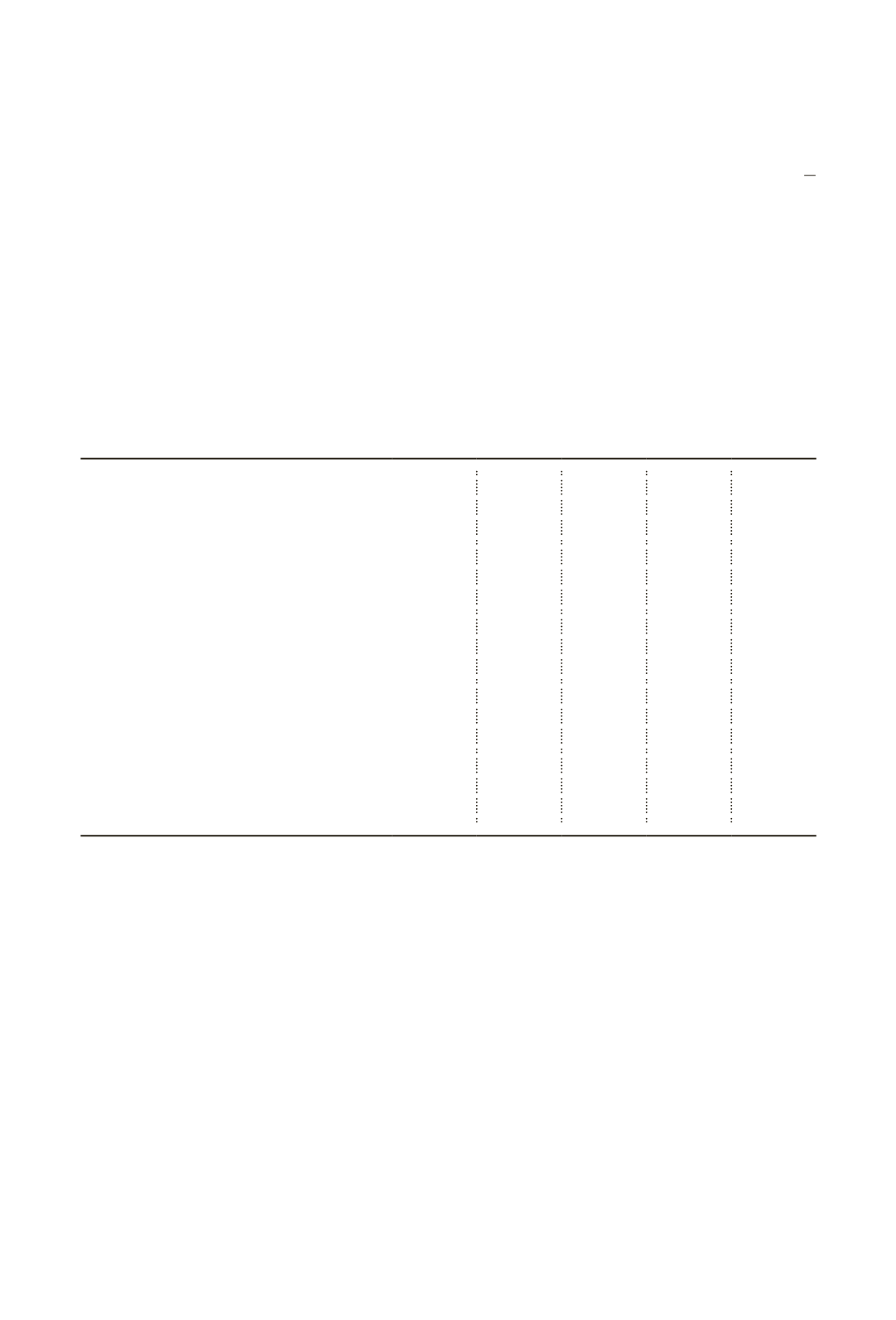

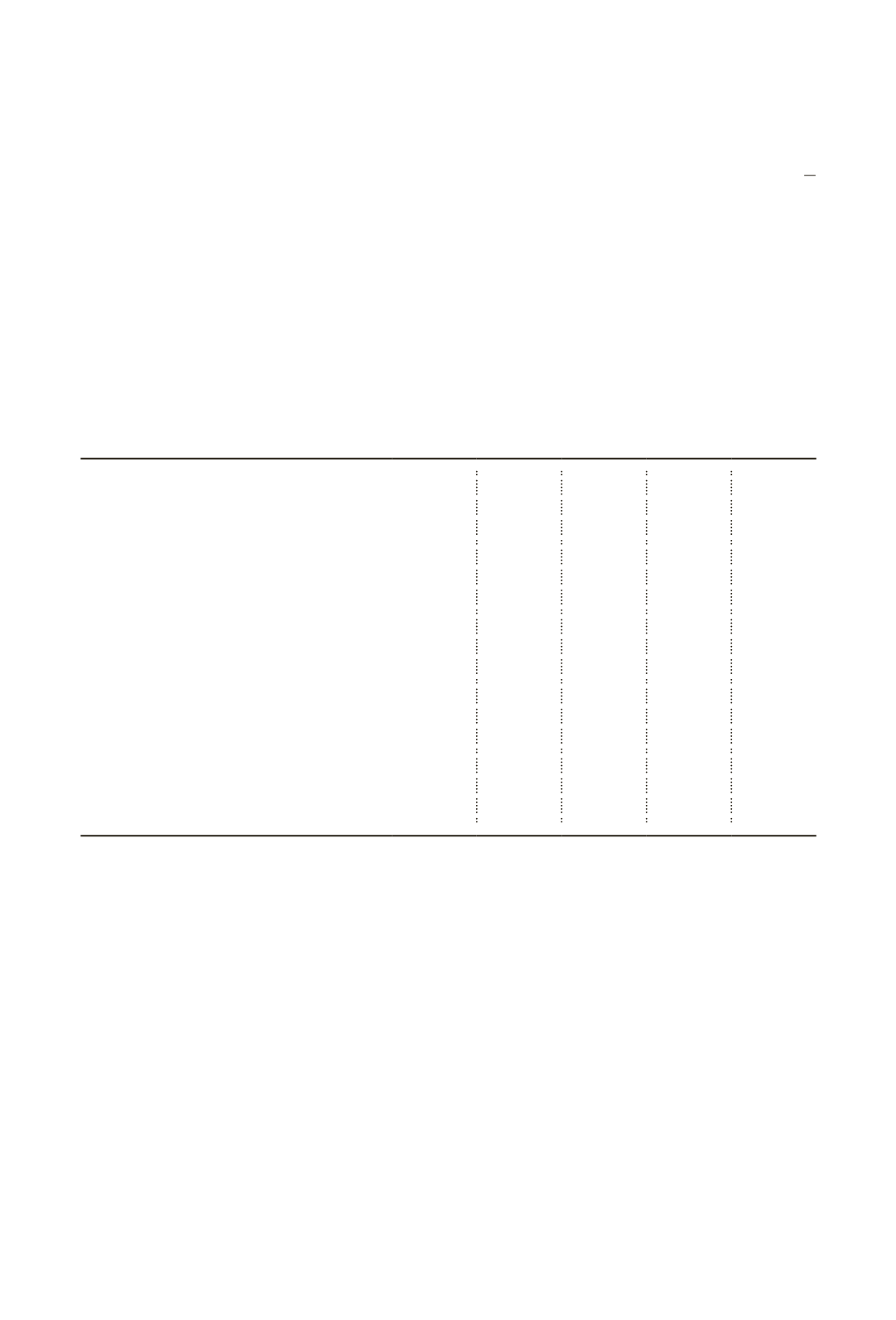

GroupQuarterlyResults

Q1

Q2

Q3

Q4 Full Year

$’000

$’000

$’000

$’000

$’000

Revenue

2017

1,001

1,421

826

1,754

5,002

2016

5,966

8,125

5,026

2,403

21,520

GrossProfit / (loss)

2017

1,561

594

(77)

541

2,619

2016

2,361

1,555

133

1,622

5,671

Net (loss) /profit

2017

(1,938)

(2,060)

(3,530)

(3,162)

(10,690)

2016

(2,757)

371

(1,483)

(4,458)

(8,327)

Net (loss) /profit*

2017

(245)

(1,474)

(2,681)

(2,251)

(6,651)

2016

(163)

439

(2,165)

(7,621)

(9,510)

Grossprofitmargin

2017

156%

41%

-9%

31%

52%

2016

40%

19%

3%

67%

26%

* Excluding foreign exchange gain / losses

. 31

ANNUAL

REPORT

20 1 7

THE BE ST

I N US